Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 20 July 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

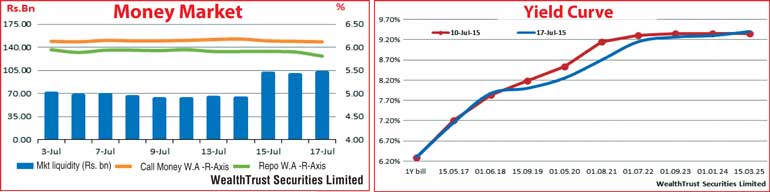

The secondary bond market witnessed considerable volatility during the week ending 17 July, with yields continuing its increasing trend during the first half of the week. The sharp increase in weighted averages by 100 basis points (bp) and 76 bp at the bond auctions on the 15.10.2018 and 01.09.2023 maturities to 8.18% and 9.58% respectively against similar maturities auctioned previously along with the increase in Treasury bill weighted averages for a third consecutive week was seen as the reason behind the increase in yields. The yields on the liquid maturities of 01.06.2018, 15.09.2019, 01.05.2020, 01.08.2021, 15.10.2021, 01.10.2022 and 01.09.2023 was seen increasing to weekly highs of 8.10%, 8.35%, 8.55%, 9.30%, 9.25%, 9.35% and 9.70% respectively during the beginning of the week.

However, foreign buying for bond maturities and coupon roll overs on selected maturities coupled with liquidity increasing to over a six week high saw yields dip once again towards the latter part of the week to hit weekly lows of 7.85%, 8.00%, 8.30%, 8.70%, 8.90%, 9.15% and 9.28%, reflecting a shift downwards on the belly end of the yield curve week on week. In addition, a limited amount of activity was witnessed on the 15.03.2025 maturity as well, within the range of 9.40% to 9.70% during the week.

Meanwhile in money markets, overnight repo rate decreased during the week ending 17 July to average 5.89% against its previous week’s average of 5.93% as surplus liquidity increased during the week to average Rs. 85.90 billion against its previous week’s average of Rs.65.42 billion.

Rupee dips during the week

The rupee lost ground during the week on the back of importer demand to a low of Rs. 133.80 in comparison to its previous week’s closing level of Rs. 133.60. The daily average USD/LKR traded volume for the first four days of the week was at $ 49.48 million.

Some of the forward dollar rates that prevailed in the market were 1 month – 134.40/48; 3 months – 135.45/60 and 6 months – 136.95/15.