Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 11 June 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

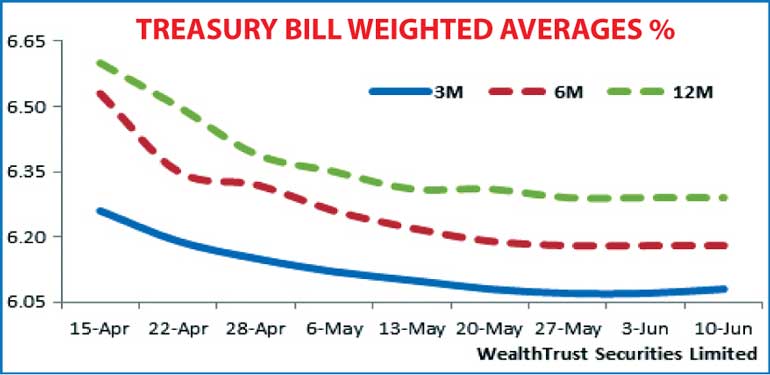

The weighted averages (W.Avgs) on the 182 day and 364 day Bills were seen remaining steady at 6.18% and 6.29% for a third consecutive week at its weekly Treasury Bill auction conducted yesterday, while the W.Avg on the 91 day Bill was seen recording an increasing for the first time in nine weeks by one bp to 6.08%.

The total accepted amount exceeded the total offered amount of Rs. 22 billion by Rs. 3.60 billion with the 91 day Bill accounting for 54.41% of the total accepted amount.

In secondary Bond markets, activity was seen moderating yesterday as yields was seen closing the day broadly steady. A limited amount of activity was witnessed on the liquid maturities 1 June 2018, 15 September 2019, 1 May 2020 and 1 January 2024 within the thin range of 7.58% to 7.60%, 7.98% to 8.01%, 8.15% to 8.18% and 8.85% to 8.87% respectively.

Meanwhile in money markets yesterday, overnight call money and repo rates remained steady to average at 6.11% and 5.85% respectively despite surplus liquidity dipping to Rs. 86.58 billion.

Rupee remains mostly unchanged

The USD/LKR rate on spot contracts continued to remain at Rs. 133.80 yesterday as markets were inactive. The total USD/LKR traded volume on 9 June 2015 stood at $ 49.95 million.

Reuters: The rupee closed steady on Wednesday as a State-run bank sold dollars at 133.80, while hopes the currency would appreciate in the short-term faded with the Central Bank defending the currency via moral suasion, dealers said.

The spot currency traded steady at 133.80 as one of two State-run banks through which the Central Bank usually directs the market sold dollars at that level.

“We see the State bank selling ample dollars for foreign investors who are exiting their portfolios in Government securities gradually, while it has restricted the supply for locals,” a currency dealer said on condition of anonymity.

“The market perception over rupee strengthening due to inflows is fading because we see a slight downward pressure on the rupee. Banks do not get adequate amount of dollars as and when they need.”

Many dealers said the Central Bank has started to defend the currency through moral suasion. Central bank officials were not immediately available for comment.

The State-run bank reduced the spot rupee’s level to the dollar by 10 cents to 133.80 on Tuesday after keeping it at 133.90 for the last five sessions through Monday. The move came amid tepid dollar sales by exporters and concerns over the continuing political uncertainty, dealers said.

The market expects the rupee to be stable so long as the Central Bank offers dollars, but its stability will depend on the amount of inflows the country is able to get.

One-week forwards ended steady at 133.95/134.10 per dollar, while three-month forwards, which have been actively trading over the last few weeks in the absence of spot, ended at 135.70/90, little changed from Tuesday’s close of 135.50/136.00.