Friday Mar 06, 2026

Friday Mar 06, 2026

Thursday, 6 August 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

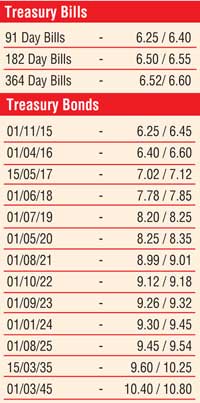

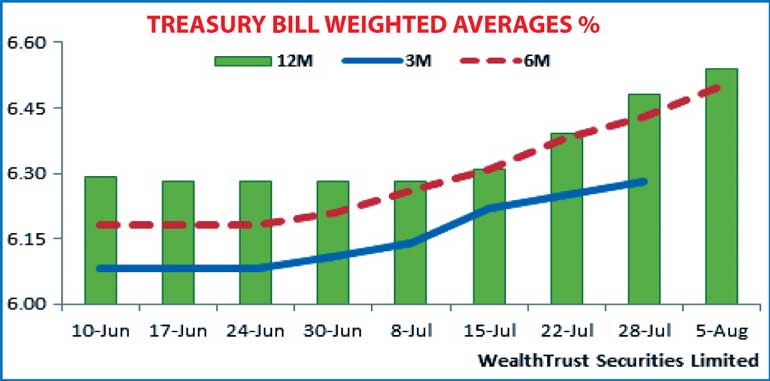

The weighted averages at the weekly Treasury bill auction conducted yesterday continued their increasing trend for a sixth consecutive week as the 182-day and 364-day maturities were seen increasing by 07 basis points and 06 basis points respectively to 6.50% and 6.54%, in the absence of the 91-day maturity been on offer.

This week the 182-day bill dominated the auction as it represented 79.64% of the total accepted amount of Rs. 21.25 billion against its initial total offered amount of Rs. 16 billion.

In secondary market bonds yesterday, activity moderated with a limited amount of movement witnessed on the 01.08.2021, 01.10.2022 and the 01.08.2025 maturities within the range of 8.99% to 9.00%, 9.14% to 9.15% and 9.50% to 9.52% respectively.

In secondary market bills, the 182-day and 364-day bills were quoted at levels of 6.50/55 and 6.52/60 respectively post-auction.

In money markets, overnight call money and repo rates remained steady to average 6.11% and 5.82% respectively as surplus liquidity stood at Rs. 109.32 billion yesterday.

Rupee remains steady

The USD/LKR rate on spot contracts remained steady for a third consecutive day at Rs. 133.50 yesterday. The total USD/LKR traded volume for the previous day (04-08-15) was $ 26.17 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 134.10/15; 3 Months - 135.10/25 and 6 Months -136.35/55.