Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Thursday, 3 December 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

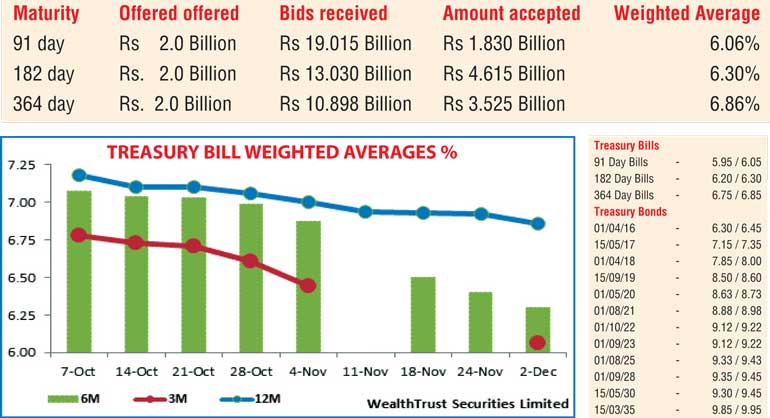

The weighted averages (W.Avgs) at the weekly Treasury bill auction conducted yesterday declined for an eighth consecutive week.

The 91 day bill reflected the sharpest decline of 38 basis points (bp) to 6.06% against its previous W.Avg of 6.44% recorded four weeks back while the 182 day and 364 day bills dipped by 10 bp and six bp respectively week on week to 6.30% and 6.86% respectively.

A total amount of Rs. 9.97 billion was accepted against its total offered amount of 6.0 billion with the 182 day bill representing 46.28% of this volume.

In secondary bond markets, buying interest continued to remain yesterday; mainly on the long end of the yield curve as yields on the 15 March 2035 maturity was seen dipping to an intraday low of 9.90% against its days opening high of 10.00%. In addition, yields on the 15 September 2019, 1 May 2020, 1 August 2021, 1 October 2022 and 1 September 2023 maturities were seen dipping to lows of 8.55%, 8.65%, 8.92%, 9.15% each respectively as well.

Meanwhile, the Open Market Operations (OMO) department of Central Bank will conducted a second auction for the outright sales of Treasury bills under its holding today. A total amount of Rs. 15 billion will be on offer consisting of Rs. 5 billion each for durations of 56 days, 70 days and 77 days.

In money markets, overnight call money and repo rates remained broadly steady to average 6.31% and 5.90% respectively as liquidity remained at Rs. 136.19 billion yesterday.

Rupee steady in thin trade

The USD/LKR rate was seen closing the day steady at Rs. 143.20/30 yesterday as markets were at equilibrium. The total USD/LKR traded volume for the 1 December was $ 33.56 million. Some of the forward USD/LKR rates that prevailed in the market were one month – 143.65/75; three months – 144.45/55; and six months – 145.70/80.

Reuters) - The Sri Lankan rupee ended a tad weaker on Wednesday to hover near its record low as importer dollar demand surpassed inward remittances, dealers said.

Prime Minister Ranil Wickremesinghe on Wednesday warned of pressure on the currency due to a China-led global slowdown and a possible Federal Reserve rate hike ahead of elections in the United States.

“We have got to remember that there will be pressure on our currencies and there’ll be an increase in financial market volatility as far as we are concerned,” he said at a ceremony marking 30 years of the formal establishment of the Colombo Stock Exchange.

The rupee ended at 143.22/27 per dollar compared with Tuesday’s close of 143.20/25, and not far from an all-time low of 143.30 hit on Friday.

“The rupee ended weaker on importer (dollar) demand despite inward remittances,” said a currency dealer asking not to be named.

Dealers said the inward remittances for the festival season would ease the pressure on the local currency in the short term.

Sri Lanka is to seek an IMF stand-by arrangement to fend off a risk that its economy will be hurt next year by repercussions from events affecting major economies.

Global political risk research firm Eurasia group last week said political infighting and populist policies are likely to slow down implementation of the budget’s economic liberalisation measures.

Sasha Riser-Kositsky of Eurasia in a research note said Sri Lanka’s 2016 budget highlights the government’s weak commitment to fiscal consolidation and will leave its external accounts position vulnerable.

The rupee has dropped around 8.4 percent so far this year and 5.9 percent since the central bank allowed free-float on Sept. 4, Thomson Reuters data showed.

The central bank sold dollars worth a net $277.95 million in October and $523.80 million in September, latest data showed. Dealers said part of that money was spent to defend the rupee.

Sri Lanka’s consumer prices in November rose to a 10-month high of 3.1 percent from a year earlier, the Department of Census and Statistics said on Monday.

Commercial banks parked 136.199 billion rupees ($951.44 million) of surplus liquidity on Wednesday, using the central bank’s deposit facility at 6 percent, official data showed.