Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 17 November 2016 00:01 - - {{hitsCtrl.values.hits}}

10 year bond yield increase to a 4-month high

10 year bond yield increase to a 4-month high

By Wealth Trust Securities

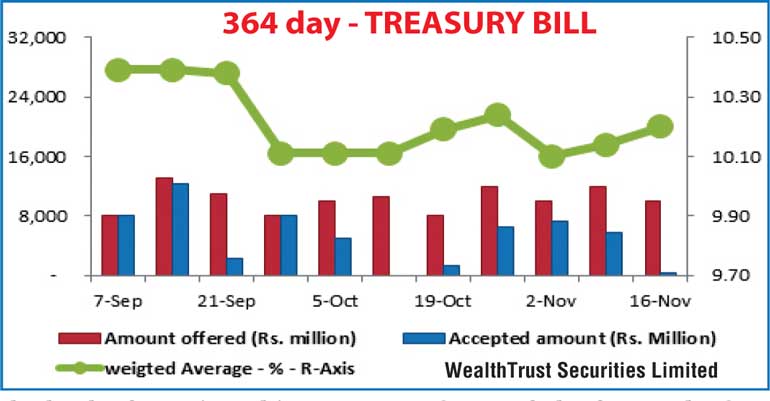

The weighted averages at yesterday’s weekly Treasury bill auction were seen increasing for a second consecutive week as the total accepted amount was seen dipping close to a 12-year low of Rs. 1.01 billion on the basis of successfully bids against its total offered amount of Rs. 29.5 billion.

The 182 day maturity increased the most by 9 basis points to 9.65% closely followed by the 364 day maturity by 6 basis points to 10.20%. Nevertheless, the 91 day bill remained steady for a fourth consecutive week at 8.60%. The total bids to offer ratio dipped to a 190 week low of 142% as well.

In the secondary bond market, yields continued to increase, mainly on the 10 year maturity of 01.08.2026 to four months high of 12.80% against its previous day’s closing level of 12.10/50. This intern saw yields on the liquid maturities of 15.10.18 and 01.05.20 hitting highs of 11.75% and 12.20% respectively against their previous day’s closing levels of 11.20/50 and 11.90/10 while two-way quotes on the rest of the yield curve increased as well.

Meanwhile, in money markets, overnight repo rates decreased marginally to average 8.65% as the Open Market Operations (OMO) department of the Central Bank continued to inject an amount of Rs. 32.02 billion on an overnight basis by way of a Reverse Repo auction at a W. Avg of 8.49%. The overnight call money rate remained steady to average 8.44%.

Rupee dips further

The USD/LKR rate on one week forward contracts as well as spot next contracts depreciated further yesterday to close the day at Rs. 148.75/85 and Rs. 148.65/70 respectively against its previous day’s closing levels of Rs. 148.60/75 and Rs. 148.45/55 on the back of continued importer demand.

The total USD/LKR traded volume for 15 November 2016 was $ 38.75 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 149.30/60; 3 Months - 151.35/50 and 6 Months - 153.80/95.