Thursday Mar 05, 2026

Thursday Mar 05, 2026

Thursday, 28 April 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

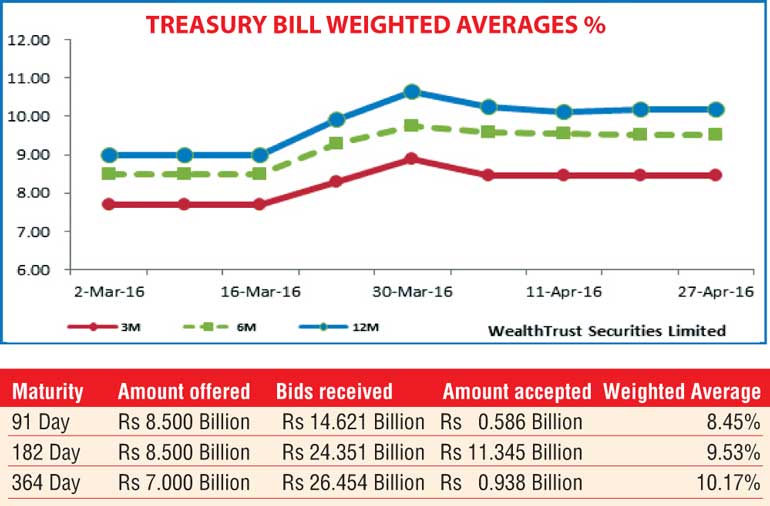

The Treasury bill weighted averages were seen holding steady at its weekly auction conducted yesterday as only Rs. 12.86 billion was accepted in successful bids against its total offered amount of Rs. 24 billion. Interestingly, the 182 day bill represented 88.15% or 11.34 billion of the total accepted amount with the accepted to offer ration dipping to a five week low of 0.54:1.

In secondary bond markets yesterday, activity was seen moderating towards the latter part of the day ahead of today’s Treasury bond auctions. Selling interest on the short end of the yield curve saw yields increase with the 15.07.2017, 15.11.18, 15.09.19 and 01.05.20 maturities changing hands within the range 10.65% to 10.80%, 11.30% to 11.40%, 11.45% to 11.50% and 11.50% to 11.60% respectively while buying interest on the belly end to the long end saw the 01.01.24 and 15.05.30 maturities change hands within the range of 12.00% to 12.05% and 12.57% to 12.60% respectively as well. Meanwhile today’s Treasury bond auctions will see a total amount of Rs. 24 billion on offer, consisting of Rs. 8 billion each on a 2.06 year maturity of 15.11.2018, a 4 year maturity of 01.05.2020 and a 6.05 year maturity of 01.10.2022. The previously recorded weighted averages on a 01.02.2018 and the 01.05.2020 maturities were 11.75% and 12.78% respectively while all bids for the 01.10.2022 were rejected.

The liquidity in money markets continued to see saw as it was seen reversing back to a surplus of Rs. 6.05 billion yesterday with call money and repo rates continuing to remain steady to average 8.15% and 8.02% respectively.

Rupee gains marginally

The Spot next rate in Forex markets was seen appreciating marginally yesterday to Rs 146.35/50 against its previous day’s closing of Rs Rs 146.50/70. The total USD/LKR traded volume for 26 April was US $ 64.05 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 147.25/50; 3 Months - 149.25/50 and 6 Months - 151.50/00.