Wednesday Jan 15, 2025

Wednesday Jan 15, 2025

Thursday, 9 July 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

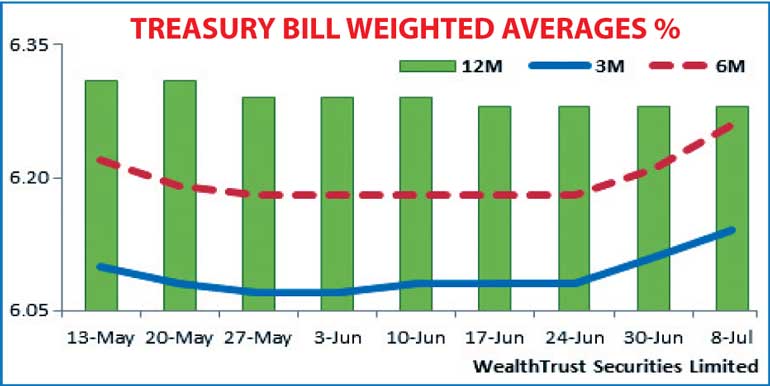

The weighted averages on the 91 day and 182 day maturities continued its increasing trend at yesterday’s weekly Treasury bill auction for a second consecutive week.

The 91 day bill recorded an increase of three basis points (bp) to 6.14% and the 182 day bill by 05 bp to 6.26% while the weighted average on the 364 day bill remained unchanged at 6.28% for a second consecutive week as well.

The 91 day bill continued to dominate the auction as it represented 53% of the total accepted amount of Rs. 24.3 billion against its total offered amount of Rs. 22 billion. Nevertheless in secondary bill markets; demand for the 91 day bill saw it been quoted at levels of 6.07/10 subsequent to the auction.

In secondary bond markets, the decreasing trend witnessed during early hours of trading yesterday reversed subsequent to the release of the auction results as yields close the day marginally higher in comparison to its morning lows.

The liquid two six year maturities (i.e. 1 May 2021 and 1 August 2021) saw its yields dipping to intraday lows of 8.80% and 8.85% respectively before closing marginally higher at levels of 8.80/85 and 8.85/90 once again.

Meanwhile today’s Treasury bond auction conducted in lieu of a Treasury bond maturity of Rs. 86.4 billion due on 15 July, will see an total amount of Rs. 40 billion on offer consisting of Rs. 15 billion each on a 4.09 year maturity of 1 May 2020 and a 7.02 year maturity of 1 October 2022 and a further Rs. 10 billion on a 6.03 year maturity of 15 October 2021.

Meanwhile in money markets, the surplus liquidity of Rs. 65.51 billion saw overnight call money and repo rates averaging at 6.14% and 5.94% respectively yesterday.

Rupee stagnant for a sixth consecutive day

The USD/LKR rate on spot contracts remained unchanged for a sixth consecutive day to close day at Rs. 133.60 yesterday.

The total USD/LKR traded volume for the previous day (7 July) stood at $ 55.60 million.

Some of the forward dollar rates that prevailed in the market were: one month – 134.16/20; three months – 135.30/40 and six months – 136.90/00.