Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 3 September 2015 00:00 - - {{hitsCtrl.values.hits}}

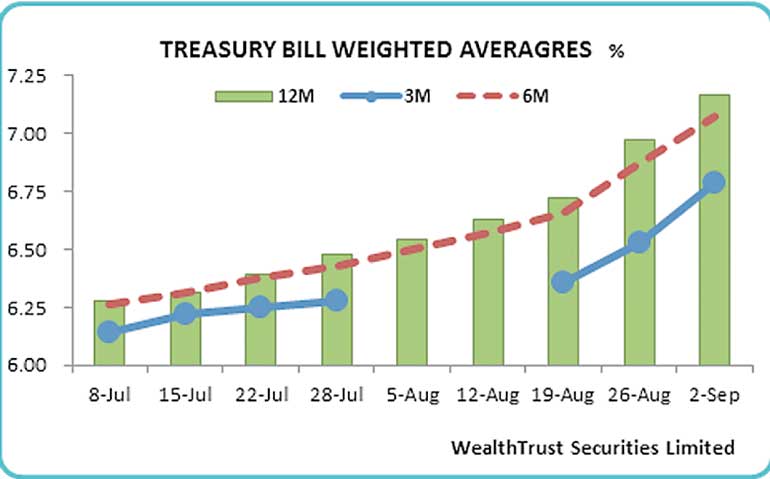

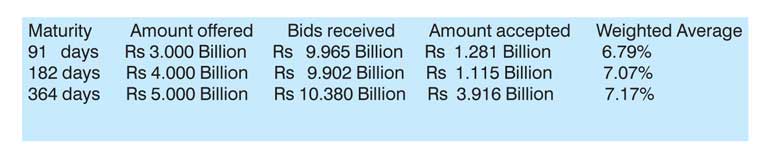

The weighted averages at yesterday’s weekly Treasury bill auction were seen increasing for a 10th consecutive week to six month highs, breaking the 7.00% physiological barriers for the first time since 11 March.

The 91 day bill led the sprint, reflecting an increase of 26 basis points to 6.79% while the 182 day and 364 day bills increased by 20 basis points each to 7.07% and 7.17% respectively. The total accepted amount dipped to a 17-month low of 3.90 billion with Rs. 12 billion being the initial total offered amount.

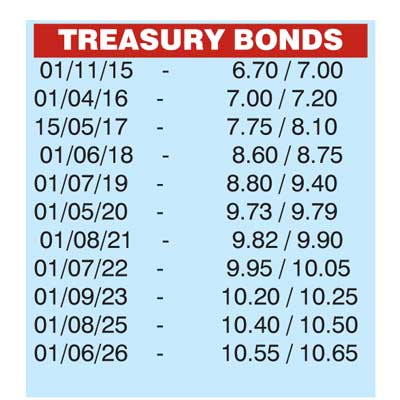

The activity in secondary market bonds continued to remain high yesterday as yields on the liquid maturities of 1 May 2020, 1 August 2021, 1 September 2023, 1 August 2025 and 1 June 2026 were seen increasing further to hit intraday highs of 9.80%, 9.85%, 10.25%, 10.50% and 10.65% respectively before bouncing back to close the day at levels of 9.72/79, 9.82/90, 10.20/25, 10.40/50 and 10.55/65 on fresh buying interest.

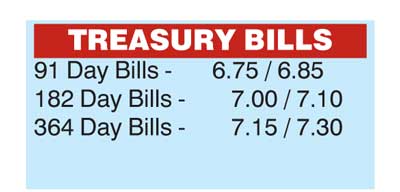

In secondary market bills, duration around the 91 day and 182 day bills were seen changing hands within the range of 6.75% to 6.85% and 7.00% to 7.10% post auction.

Meanwhile in money markets, overnight repo rates increased further to average 6.40% as the Open Market Operations (OMO) department of Central Bank refrained from conducting an overnight reverse repo auction yesterday. However the overnight call money rate remained steady to average 6.31% as surplus liquidity in the market increased further to Rs. 42.46 b.

Rupee remains steady

The USD/LKR rate on spot contracts remained steady for a second consecutive day to close the day at Rs. 134.50. The total USD/LKR traded volume for 1 September was $ 41.27 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 135.14/24; three months – 136.32/42; six months – 138.14/24.