Wednesday Jan 15, 2025

Wednesday Jan 15, 2025

Thursday, 23 July 2015 00:00 - - {{hitsCtrl.values.hits}}

Secondary market bond yields increase for second consecutive day

By Wealth Trust Securities

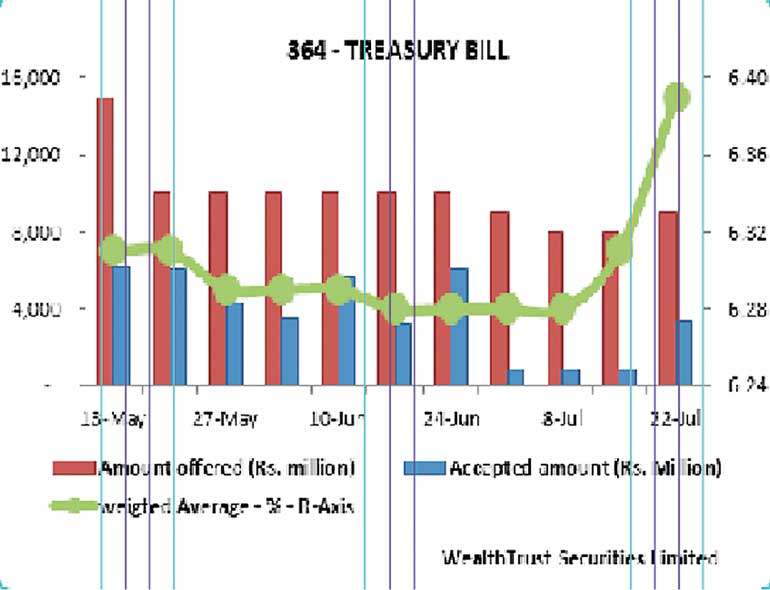

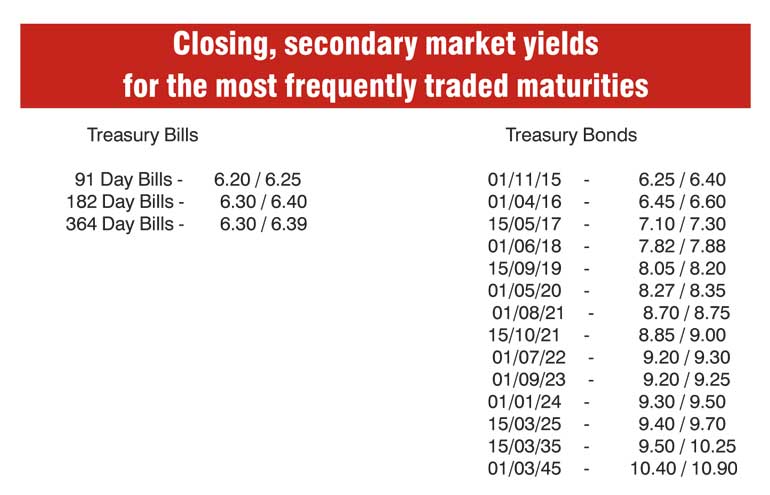

The upward trend in primary market rates continued at yesterday’s weekly Treasury bills auction, with the weighted averages on the 91 day bill and the 182 day bill increasing by three basis points (bp) and seven bp respectively to a 14-week high of 6.25% and 6.38% followed by the 364 day bill increasing by eight bp to a 12 week high of 6.39%. Interestingly, the accepted amount on the 91 day bill was 269% above its initial offered amount of Rs. 6 billion while the overall accepted amount exceeded the total offered amount by Rs. 6.7 billion.

In secondary market bonds yesterday, yields were seen increasing for a second consecutive day mainly on the liquid maturities of 1 June 2018, 1 May 2020, 1 August 2021, 1 July 2022, 1 October 2022 and 1 September 2023 to intraday highs of 8.86%, 8.35%, 8.85%, 9.25%, 9.25% and 9.40% respectively on the back of continued selling interest.

However, buying interest on the 1 August 2021 and 1 September 2023 maturities saw its yields dip to intraday lows of 8.75% and 9.35% once again. Meanwhile on secondary market bills, the 91 day bill was seen quoted at levels of 6.20/25 post auction.

Meanwhile in money markets yesterday, overnight call money and repo rates remained mostly unchanged to average 6.11% and 5.81% respectively despite surplus liquidity dipping to Rs. 89 billion.

Rupee remains stable

Meanwhile in Forex markets yesterday, the USD/LKR rate on spot contracts remained steady to close the day at Rs. 133.70. The total USD/LKR traded volume for the previous day (21 July) stood at $ 51.65 million.

Some of the forward dollar rates that prevailed in the market were one month – 134.24/30; three months – 135.50/56 and six months – 137.05/12.

Reuters: The rupee ended steady on Wednesday in dull trade as a State-owned bank maintained its dollar-selling rate at 133.70, dealers said.

There was however downward pressure on the rupee due to demand for the greenback from importers, the dealers said.

The spot rupee closed steady at 133.70/80 per dollar on Wednesday a day after the State-run bank cut the currency’s peg against the dollar by 10 cents to allow the exchange rate to appreciate.

Since 13 July, the spot currency remained unchanged at 133.80 through Monday following the State-owned bank’s decision to raise the dollar-selling rate by 0.15% to 133.80.

“The rupee ended steady in dull trade with mild importer (dollar) demand. Exporters are reluctant to convert,” a currency dealer said.

The central bank on Friday said it entered into a $1.1 billion currency swap agreement with the Reserve Bank of India, which dealers said would boost the country’s reserves and confidence in its currency.