Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 29 July 2015 00:31 - - {{hitsCtrl.values.hits}}

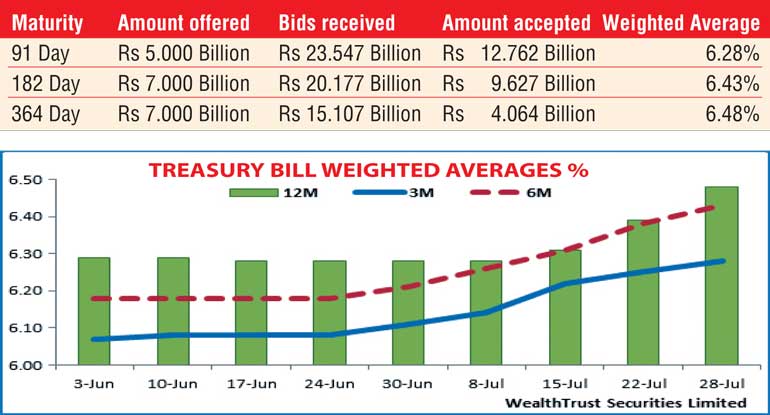

The u pward trend in weighted averages (W. Avg’s) at the weekly Treasury bill auctions continued for a fifth consecutive week at yesterday’s auction as well, with the 364-day bill recording the sharpest increase by 09 basis points (bp) to 6.48% closely followed by the 182-day bill by 05 bp to 6.43% and the 91-day bill by 03 bp to 6.28%.

pward trend in weighted averages (W. Avg’s) at the weekly Treasury bill auctions continued for a fifth consecutive week at yesterday’s auction as well, with the 364-day bill recording the sharpest increase by 09 basis points (bp) to 6.48% closely followed by the 182-day bill by 05 bp to 6.43% and the 91-day bill by 03 bp to 6.28%.

Continuing with the trend witnessed over the past few weeks, the 91-day bill dominated the auction as it represented 48.24% of the total accepted amount of Rs. 26.45 billion which was Rs. 7.45 billion above the initial total offered amount of Rs. 19 billion.

In secondary market bonds yesterday, yields were seen increasing subsequent to the release of the auction results mainly on the 01.08.2021 and the 01.09.2023 maturities to intraday highs of 8.88% and 9.30% respectively against its days opening lows of 8.84% and 9.23% on the back of moderate volumes changing hands.

In addition, a limited amount of activity was witnessed on the 01.06.2018, 01.07.2019 and the 01.05.2020 maturities within the range of 8.82% to 8.87%, 8.14% to 8.18% and 8.24% to 8.28% respectively.

In secondary bill markets, durations surrounding the 91- and 182-days bills were quoted at levels of 6.20/30 and 6.40/48 post auction.

Meanwhile, in money markets, overnight call money and repo rates remained steady to average 6.13% and 5.81% respectively despite surplus liquidity dipping to Rs. 79.33 billion yesterday.

Rupee appreciates marginally

The USD/LKR rate was seen gaining by 10 cents yesterday to Rs. 133.60 subsequent to holding steady at Rs. 133.70 for five previous trading sessions. The total USD/LKR traded volume for the previous day (27-07-15) stood at $ 63.50 million.

Some of the forward dollar rates that prevailed in the market were 1 month - 134.20/30; 3 months - 135.10/25 and 6 months - 136.40/60.