Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 17 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

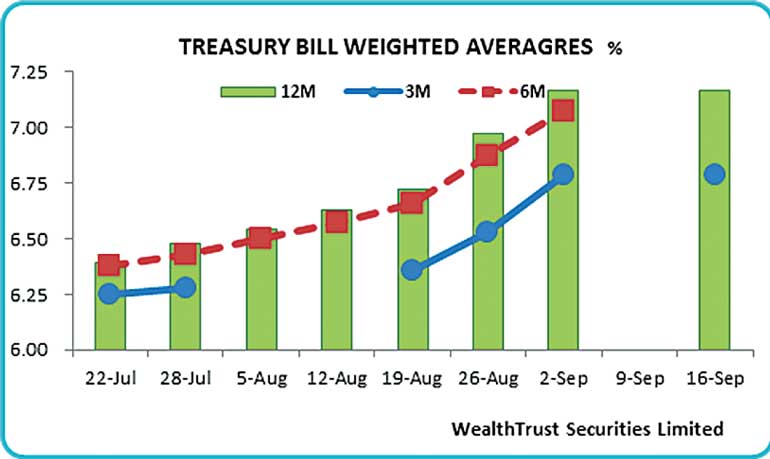

The weekly Treasury bill Weighted Averages (W. Avgs) were seen recording bullish returns of 6.79% and 7.17% on the 91-day and 364-day maturities respectively at its auction conducted yesterday following the rejection of all bids at its previous week’s auction.

However, all bids for the 182-day bill were rejected as only a total amount of Rs. 5.5 billion was accepted against a total offered amount of Rs. 24 billion.

In secondary market bonds, following the outcome of the auction yields were seen dipping marginally mainly on the liquid maturities of 01.07.2019, 01.05.2020, 01.10.2022 and 01.09.2023 to daily lows of 9.15%, 9.50%, 10.00% and 9.98% respectively against its day’s opening highs of 9.20%, 9.55%, 10.03% and 10.02%.

However, profit-taking curtailed any further downward movement. In secondary bill markets, demand saw the November 2015, February and August 2016 bills change hands within the range of 6.55% to 6.65%, 6.85% to 6.95% and 7.00% to 7.10% respectively.

In money markets, overnight call money and repo rates remained mostly unchanged yesterday to average 6.35% and 6.37% respectively despite surplus liquidity stood at Rs. 63.95 billion.

Rupee depreciates further

The rupee on spot contracts was seen depreciating further to close the day at Rs. 140.80/00 subsequent to hitting a new historical low level of Rs. 140.90 against its previous day’s closing levels of 140.15/25. The total USD/LKR traded volume for the 15 September 2015 was $ 18.25 million. Some of the forward USD/LKR rates that prevailed in the market were one month - 141.40/70; three months - 142.65/80 and six months - 144.20/35.

Reuters: Shares ended at one-week low on Wednesday, falling for a second straight day as investors turned cautious amid a weakening rupee and an upward trend in market interest rates.

The main stock index ended down 0.21% or 15.03 points at 7,137.40, its lowest since 8 September.

Turnover stood at Rs. 771.3 million ($ 5.48 million), well below this year’s daily average of Rs. 1.12 billion. The turnover has been about half of this year’s daily average since 31 August, stock exchange data showed.

SC Securities Ltd. in an investor note said the fall was “due to lack of any clear direction”.

Analysts said investors were awaiting to see how the government is going to bridge the budget deficit and where the revenue is going to come in its October budget.

A weak rupee curbed investor risk appetite and rising market interest rates also hit sentiment, with t-bill yields at their highest in more than five months at the last auction. The rupee ended 0.4% weaker on Wednesday, marking a record low for a fourth session in a row. Foreign investors were net buyers of Rs. 46.6 million worth of shares on Wednesday, but they have been net sellers of Rs. 2.97 billion worth of equities so far this year.

Shares in Lanka ORIX Leasing Co Plc fell 5.48%, while Peoples Leasing & Finance Plc fell 4.24%.