Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 28 May 2015 01:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

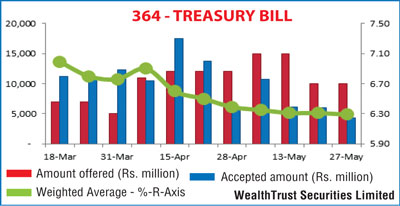

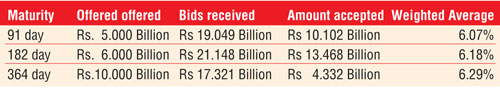

The weighted average (W.Avg) on the 364-day bill resumed its downward trend after a lapse of one week to record a dip of two basis points to 6.29% while the W.Avg’s on the 91-day and 182-day bills dipped by one basis point each to 6.07% and 6.18% respectively.

The auction attracted successful bids of Rs. 27.9 billion against its initial total offered amount of Rs. 21 billion.

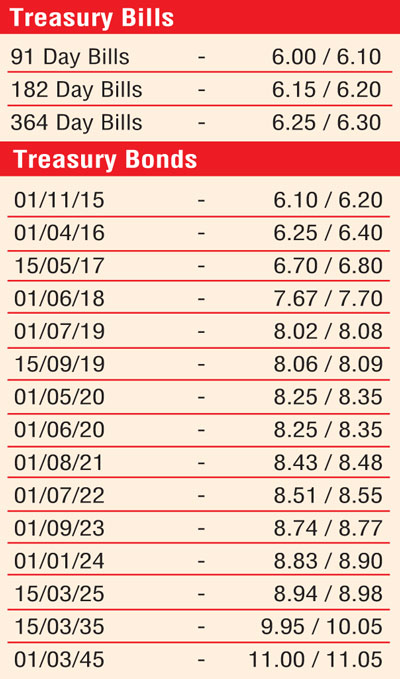

Meanwhile, in secondary bond markets yesterday, activity reduced drastically with a limited amount of volumes changing hands on the 15.09.2019, 01.08.2021 and 15.03.2025 maturities within a very thin range of 8.07% to 8.09%, 8.44% to 8.46% and 8.95% to 8.96% respectively.

Meanwhile, at today’s bond auction an total amount of Rs. 20 billion will be on offer consisting of Rs. 3 billion on a 4.11-year maturity of 01.05.2020, Rs. 7 billion on a 8.03-year maturity of 01.09.2023 and Rs. 10 billion on a 14.11 year maturity of 15.05.2030.

Meanwhile, in money markets yesterday, overnight call money and repo rates remained steady to averaged 6.10% and 5.83% respectively as surplus liquidity stood at Rs. 117.44 billion.

Rupee dips further

In Forex markets yesterday, the rupee on active three-month forward contracts dipped further to close the day at Rs. 138.20/50 against its previous day’s closing of Rs. 136.80/20 on the back of continued importer demand and exporters holding back. The total USD/LKR traded volume for the previous day (26-05-15) stood at $ 55.05 million.

The six months forward dollar rate that prevailed in the market was 139.70/00.