Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 25 February 2016 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

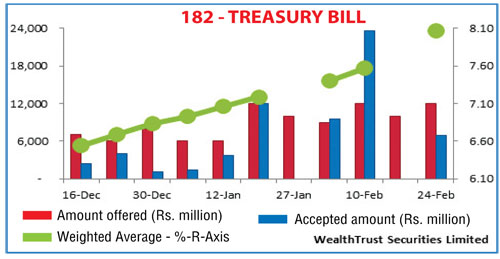

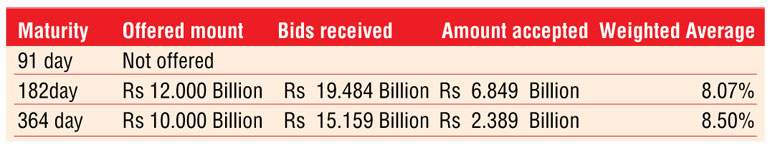

The first primary auction following the policy rate hike saw weighted averages spike at the weekly Treasury bill auction conducted yesterday. The 364 day bill reflected an increase of 55 basis points to 8.50% while the 182 day bill increased by 50 basis points to 8.07%. The 91 day bill was not on offer. The 182 day bill represented 74% of the total accepted amount of Rs.9.2 billion which was Rs.12.7 billion lower than the initial offered amount of Rs.22 billion.

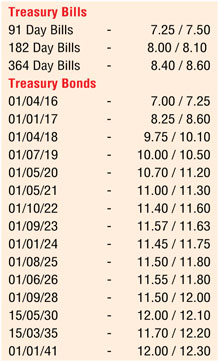

In the secondary bond market, the upward trend in yields continued mainly on the liquid seven year maturity of 01.09.2023 as it was seen hitting an intraday high of 11.70% in comparison to its previous day’s closing levels of 11.25/40 on the back of moderate  volumes changing hands. However, following the auction outcome yield was seen dipping once again to an intraday low of 11.55%. In addition, the 14 year maturity of 15.05.2030 was seen changing hands within the range of 11.94% to 12.02% as well while the 182 day bill closed the day at 8.00/10 post auction.

volumes changing hands. However, following the auction outcome yield was seen dipping once again to an intraday low of 11.55%. In addition, the 14 year maturity of 15.05.2030 was seen changing hands within the range of 11.94% to 12.02% as well while the 182 day bill closed the day at 8.00/10 post auction.

Meanwhile in money markets, the overnight call money rate and repo rate averaged 7.51% and 7.09% respectively as surplus liquidity increased marginally to Rs.33.90 billion yesterday.

Rupee loses ground marginally

The USD/LKR rate on the active one week forward contract was seen depreciating marginally to close the day at Rs.144.65/70 against its previous day’s closing levels of Rs.144.60/65 on the back of importer demand. The total USD/LKR traded volume for 23 February was US $ 65.25 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 145.20/30; 3 Months - 146.50/60 and 6 Months - 148.50/60.