Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 1 June 2017 00:29 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weighted average yields at yesterday’s Treasury bill auction decreased across the board, as the total bids received remained high at Rs. 75.3 billion.

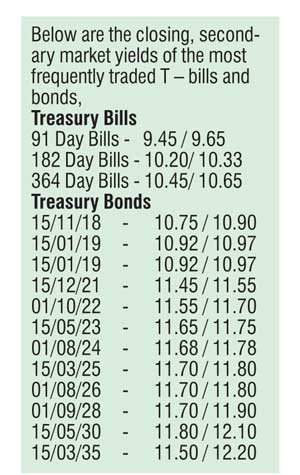

The auction successfully attracted the total offered amount of Rs. 29.5 billion with the 182-day maturity continuing to dominate the auction, representing 59.83% of the total accepted amount. The weighted average yield of the 182-day maturity decreased the most by five basis points to 10.35% closely followed by the 91-day and 364-day maturities by one and two basis points respectively to 9.61% and 10.71%.

Meanwhile, inflation on its point-to-point average was seen declining for a second consecutive month to record 6.00% for May while the annualised average increased for a fifth consecutive month to 5.40%.

This in turn resulted in the yields of the shorter end maturities decreasing in the secondary bond market, backed by fresh buying interest. The shorter end maturities of 15.01.19, 01.05.19 and 01.07.19 were seen hitting lows of 10.96%, 11.02% and 11.00% respectively against their previous day’s closing levels of 11.00/05, 11.05/10 and 11.10/20.

However, the medium term maturities such as 01.09.23, 01.01.24 and 01.08.26 were seen hitting highs of 11.67%, 11.76% and 11.74% respectively against their previous day’s closing levels of 11.60/68, 11.60/70 and 11.72/80.

The total secondary market Treasury bond transacted volume for 30 May 2017 was Rs. 3.00 billion. In money markets, the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 8.17 billion on an overnight basis at a weighted average of 7.27% by way of a repo auction as the net surplus liquidity in the system stood at Rs. 8.09 billion. The overnight call money and repo rates averaged 8.72% and 8.75%.

Rupee closes stronger

The USD/LKR rate on spot contracts were seen closing the day marginally higher at Rs. 152.85/90 against its previous day’s closing levels of Rs. 152.90/00, subsequent to hitting a low of Rs. 153.05.

The total USD/LKR traded volume for 30 May was $ 39.00 million. Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 154.00/10; 3 Months - 156.00/15 and 6 Months - 158.90/10.