Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 17 March 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

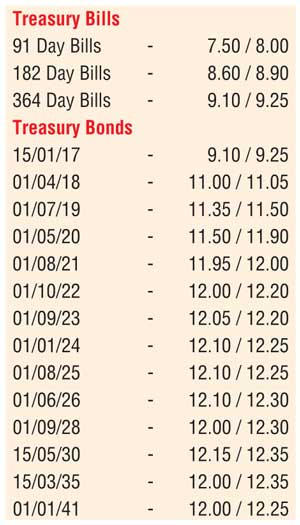

All bids received for yesterday’s weekly Treasury bills auction were rejected for a second consecutive week. The amalgamated offered amount over the past two weeks was Rs. 42 billion. In secondary market bonds, selling interest during morning hours of trading saw yields on the 1 August 2021 maturity increase to 12.00% while the 1 April 2018 maturity continued to change hands within the range of 11.00% to 11.05%.

This was ahead of today’s Treasury bond auctions where a total amount of Rs. 3 billion will be on offer consisting of Rs. 1 billion each on a 01.03 year maturity of 15 June 2017, a 04.01 year maturity of 1 May 2020 and a 07.09 year maturity of 1 January 2024.

Meanwhile in money markets, the net surplus liquidity was seen dipping drastically to Rs.1.36 billion yesterday as Rs.8.09 billion was accessed from Central Bank’s Standard Lending Facility Rate of 8.00% while Rs.9.45 billion was deposited at its Standing Deposit Facility Rate of 6.50%. This led to overnight call money and Repo rates increasing marginally to average 7.85% and 7.75% respectively.

Spot contracts remain inactive

In Forex markets, the USD/LKR rate on the active one week forward contract was seen closing lower at Rs.145.35/45 yesterday due to the number of days from spot to one week increasing to ten from the standard seven days. Spot contracts continued to remain inactive. The total USD/LKR traded volume for 15 March was $ 76.25 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 145.90/20; three months – 147.50/00; and six months – 149.60/00.