Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 31 March 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

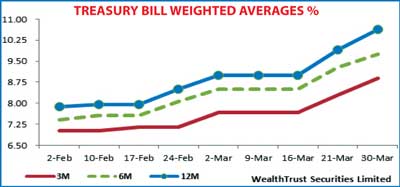

The weekly weighted averages continued to increase sharply at its Treasury bill auction conducted yesterday, reiterating its trend from the previous week. Once again, it was the 364 day bill which reflected the sharpest increase of 74 basis points (bp) to 10.64%  followed by the 91 day bill by 60 bp to 8.90% and the 182 day bill by 47 bp to 9.76%. However, contrast to the previous week, the total accepted amount was seen dipping below the total offered once again with only an total amount of Rs. 7.07 billion been accepted against a total offered amount of Rs. 21 billion.

followed by the 91 day bill by 60 bp to 8.90% and the 182 day bill by 47 bp to 9.76%. However, contrast to the previous week, the total accepted amount was seen dipping below the total offered once again with only an total amount of Rs. 7.07 billion been accepted against a total offered amount of Rs. 21 billion.

In secondary bond markets, following the monitory policy announcement at where rates were held steady, yields were seen dipping marginally on the back of buying interest. The 15.08.2018 and 15.11.2018 maturities saw volumes change hands within the range of 12.00% to 12.25% while the 01.05.2020 was seen changing hands within the range of 12.72% to 12.85%. On the long end of the yield curve, the 15.03.2025 and 15.05.2030 maturities were seen changing hands within the range of 13.50% to 13.70% and 13.70% to 13.80% respectively as well.

In money markets, the net liquidity short position was seen increasing to Rs. 17.07 billion yesterday as the amount accessed from Central Bank's SLFR was seen increasing to a staggering Rs. 31.53 billion. However, overnight call money and repo rates remained broadly steady to average 8.05% and 8.00% respectively.

Rupee continues

to slide

The USD/LKR rate on the active spot next and one week forward contracts was seen depreciating further yesterday to Rs 149.25/35 and Rs 149.35/55 respectively on the back of continued importer demand. The total USD/LKR traded volume for the 29 March was $ 57.15 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 150.00/30; 3 Months - 152.35/60 and 6 Months - 153.90/30.