Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 3 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

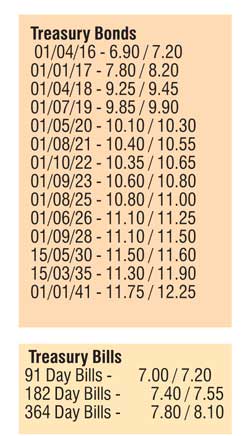

The momentum at the primary auctions remained upward as weighted averages at the weekly Treasury bill auction continued to increase after a lapse of one week for an eighth consecutive week. The weighted averages on the 91 day and 182 day bills were seen increasing by 23 basis points and 21 basis points respectively to 7.01% and 7.40% recording a forty-six (46) week and a two year high respectively. Furthermore, the weighted average on the 364 day bill was seen increasing by 07 basis points as well to 7.87% with the total accepted amount exceeded the total offered amount for the first time in three weeks. In addition, the total bids to offer ration was seen increasing to a nine week high of 2.68:1 as the total accepted amount exceeded the total offered amount of Rs.22 billion by Rs.6.50 billion.

The Treasury bill auction results coupled with the announcement of three Treasury bond auctions for the 05th of February saw yields in the secondary bond market increase further for a second consecutive day. Activity remained high on the 15.05.2030 maturity as its yield was seen increasing to a high of 11.58% against its days opening low of 11.40%. In addition, two way quotes on the 01.05.2021, 01.08.2021, 01.08.2025 and 01.06.2026 maturities were seen increasing as well. On the very short end of the yield curve, April/June and August 2016 maturities were seen changing hands within the range of 6.95% to 7.10%, 7.20% to 7.35% and 7.35% to 7.60% respectively pre and post auction results.

Meanwhile in money markets, the overnight call money and repo rates increased marginally to average at 6.79% and 6.43% respectively as surplus liquidity in the system decreased to Rs.40.49 billion yesterday.

Rupee on

spot contracts remains stable

The USD/LKR rate on spot contracts continued to remain steady to close the day at Rs.143.95/20 yesterday while the active one week forward contracts were seen closing the day at Rs.144.20/30. The total USD/LKR traded volume for the 1 February was $ 41.38 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.80/00; 3 Months - 145.85/00 and 6 Months - 147.60/90.