Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 16 June 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

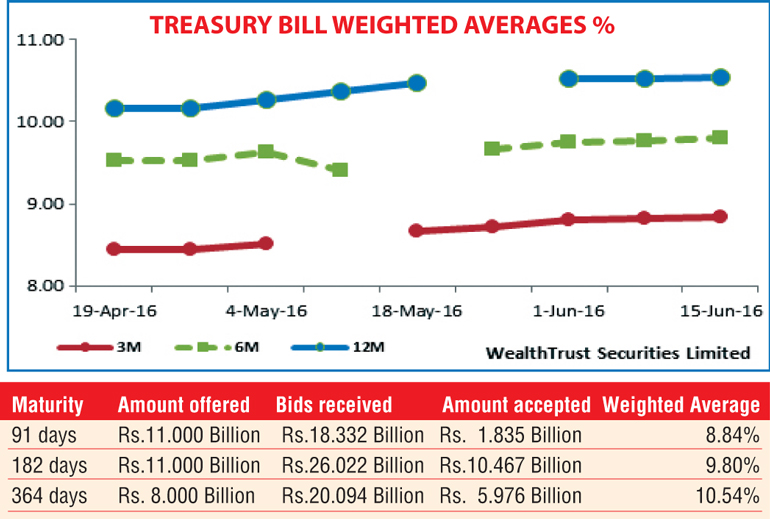

The weighted average on the 182 day bill was seen increasing by four basis points to a three-year high of 9.80% at its auction held yesterday while the weighted averages on the 91 day and 182 day maturities increased by two basis points and one basis point respectively to 8.84% and 10.54%. The auction fell short by Rs.11.72 billion as only a total amount of Rs.18.2 billion was accepted against its total offered amount of Rs.30 billion.

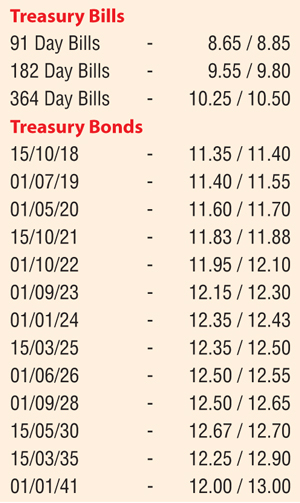

In secondary bond markets, yields were seen increasing once again yesterday mainly on the 01.01.24 and 01.06.26 maturities to intraday highs of 12.40% and 12.55% respectively against its days opening lows of 12.35% and 12.48%. However, continued foreign buying on the 15.10.18 and the 15.10.21 maturities saw it change hands within the range of 11.35% to 11.40% and 11.84% to 11.90% respectively.

Meanwhile in money markets, the overnight call money and repo rates averaged at 8.18% and 8.09% respectively as the net deficit in the system stood at Rs. 4.35 billion yesterday. The Open Market Operations (OMO) Department of Central Bank injected an amount for Rs.5 billion at a weighted average rate of 8.00% on an overnight basis once again.

Rupee dips further

The USD/LKR rate on its spot next contract depreciated further to close the day at Rs.144.95/20 against its previous day’s closing of Rs.144.90/10 as spot contracts became inactive once again. Activity shifted to the one week forward contract as it closed the day at Rs.145.45/60. The total USD/LKR traded volume for 14 June was $ 49.50 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 145.70/90; three months – 147.30/40; and six months – 149.45/55.