Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 21 January 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

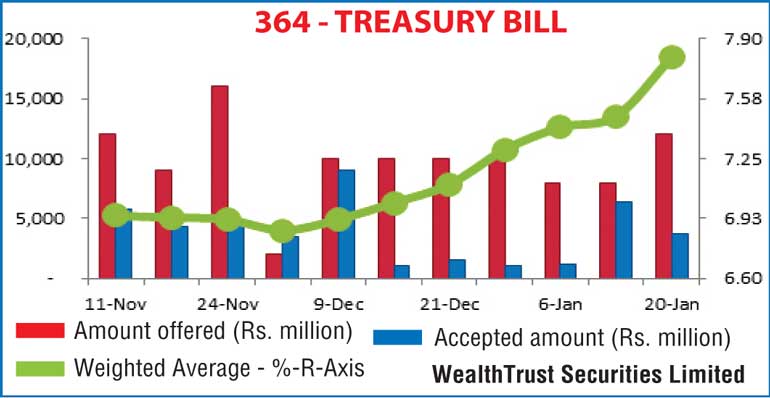

The weighted averages at yesterday’s Treasury bill auction was seen spiking with the 364 day bill recording a staggering increase of 32 basis points to 7.80%. This was followed by the 182 day bill increasing by 13 basis points as well to 7.19% reflecting a seventh consecutive week of increases.

The bids to offer ratio was seen dipping to a 120 week low of 1.72:1 against its previous week’s figure of 2.36:1 as the total accepted amount fell below the total offered amount of Rs.24 billion by Rs.8.2 billion.

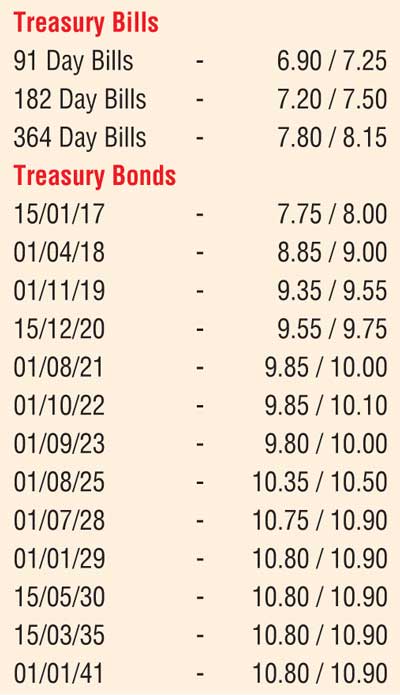

Nevertheless, continued buying interest on the long end of the yield curve by selected parties saw the 1 July 2028, 1 January 2029, 15 March 2030, 15 May 2035 and 1 January 2041 maturities change hands within the range of 10.80% to 10.85% for a second consecutive day.

However, following the outcome of the bill auction, two way quotes on the rest of the yield curve was seen widening. On the short end of the curve, August to September 2016 maturities were seen changing hands within the range of 7.65% to 7.75% and early 2017 maturities within the range of 7.75% to 7.90% as well.

Meanwhile in money markets yesterday, overnight call money and repo rates averaged at 6.89% and 6.78% respectively as surplus liquidity in the system increased further to Rs.45.06 billion.

Rupee appreciates marginally

The USD/LKR rate on spot contracts was seen appreciating marginally to close day at Rs.143.90/00 against its previous day’s closing levels of Rs.144.05/15. The total USD/LKR traded volume for 19 January was $ 37.45 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 144.65/90; three months – 145.85/20; six months – 147.60/90.