Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 25 May 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

The yield curve continued to steepen on a marginal trajectory for a third consecutive week as yields on durations ranging from 2 years to 5 years were seen dipping during the week ending 22 May, while yields on durations ranging from 6 years to 10 years were seen increasing marginally.

The expectations and final outcome of the monitory policy announcement for May, where the Central Bank was seen holding policy rates steady at 6.50% and 7.00% following a 50 basis point cut in April and the outcome of the 9.10-year Treasury bond auction where the weighted average was seen increasing by 03 basis points (bp) to 9.01% against its previous weighted average was seen contributing to this development on the yield curve.

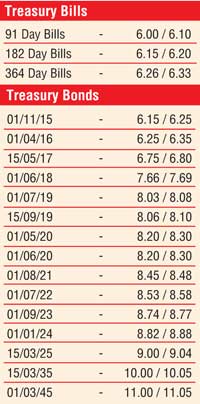

Activity remained high in secondary bond markets as yields on the 15.05.2017, 01.06.2018, 01.07.2019 and 01.05.2020 maturities were seen dipping week on week by 18 bp, 07 bp, 08 bp and 10 bp respectively subsequent to trading within intraweek lows of 6.76%, 7.63%, 8.00% and 8.20% and highs of 6.90%, 7.70%, 8.05% and 8.25%.

In addition, yields on the 01.08.2021, 01.07.2022, 01.09.2023 and 15.03.2025 maturities were seen closing the week broadly steady week-on-week subsequent to trading within weekly lows of 8.36%, 8.50%, 8.67% and 8.95% and highs of 8.46%, 8.56%, 8.76% and 9.00%.

Furthermore, on the longer end of the yield curve the 20-year maturity of 15.03.2035 was seen changing hands within the range of 10.05% to 10.15% and the 30-year maturity of 01.03.2045 within 10.95% to 11.10% during the week.

In money markets, the overnight repo rate decreased during the week to average 5.80% against its previous week’s average of 6.04% as average surplus liquidity stood at Rs. 121.14 billion during the week ending 22 May. The overnight call money rate remained mostly unchanged to average at 6.12%.

Rupee dips during

the week

In Forex markets, importer demand during the week saw the USD/LKR rate on spot contracts deprecate to a low of Rs. 133.70 while the active three months contract was seen closing the week at Rs. 136.45/55. The daily average USD/LKR traded volume for the first four trading days of the week stood at $ 37.29 million.

The six month forward dollar rate that prevailed in the market was 138.00/20.