Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 28 March 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

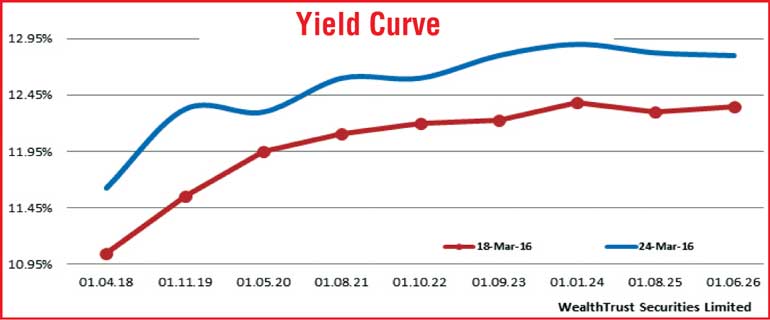

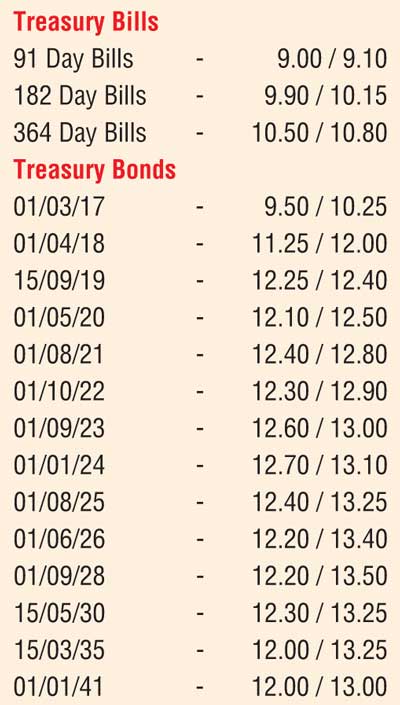

The increasing trend in secondary market bond yields witnessed over the previous nine weeks was seen intensifying during the shortened trading week ending 24 March, driven by the outcome of the weekly Treasury bill auction, at where weighted averages soared. Selling interest on the liquid 2018 maturities (01.04.18 and 15.08.18), the 15.09.2019, 01.08.2021, 01.09.2023 and 01.01.2024 saw its yields increase to weekly highs of 11.25% each, 12.35%, 12.40%, 12.70% and 12.75% respectively while two way quotes widened considerably as bids withdrew.

This in turn led to activity drying up considerably as well while the yield curve reflected a parallel shift upwards for a seventh consecutive week, mainly on the short end to the belly end of the curve. In secondary market bills, the 91 day, 182 day and 364 day maturities were seen changing hands within the range of 9.00% to 9.15%, 9.80% to 10.00% and 10.40% to 10.60% respectively post auction. Furthermore, all bids received for the four Treasury bond auctions conducted on Friday for a total of Rs. 20 billion were rejected.

Meanwhile the foreign selling component in rupee bonds was seen increasing once again to Rs. 17.58 billion for the week ending 23 March against its previous week’s outflow of Rs. 9.58 billion.

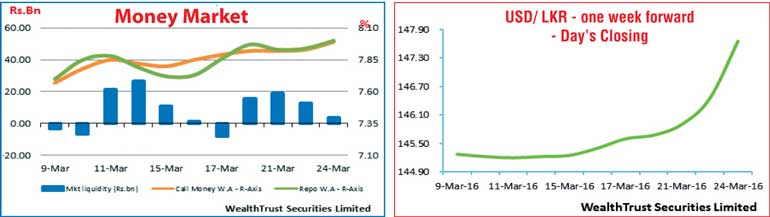

In money markets, surplus liquidity was seen reducing during the week ending 24 March to Rs. 3.87 billion as call money and Repo rates edged up marginally to average 7.95% and 7.96% respectively.

Rupee depreciates significantly

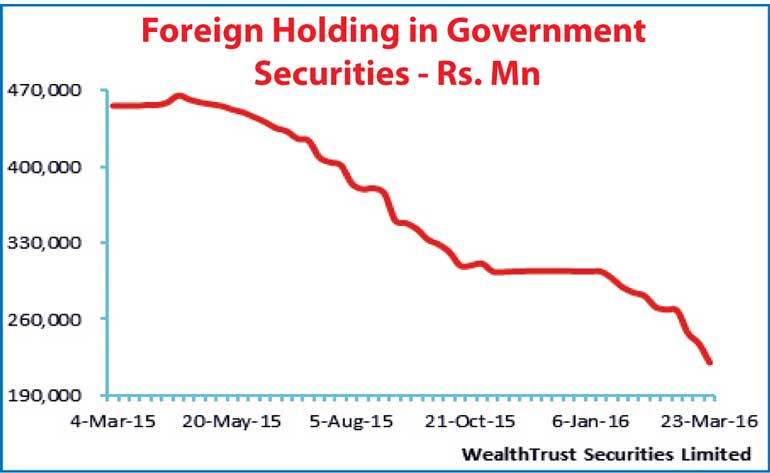

The USD/LKR rate on the active one week forward contract was seen dipping to a low of Rs. 147.50/80 by end of the shortened trading week ending 24 March against its previous weeks closing level of Rs. 145.60/75 on the back of importer demand and portfolio outflows.

Some of the forward dollar rates that prevailed in the market were one month – 148.20/40; three months – 149.90/10 and six months – 152.00/20.