Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 20 May 2015 00:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary Bond market reflected mixed fortunes yesterday as yields on the shorter leg of the curve remained steady while yields on the belly end of the curve was seen increasing marginally following the outcome of yesterday’s Bond auctions.

Furthermore, yields on the longer end of the curve were seen dipping on the back of considerable interest.

At yesterday’s auctions, all bids for the 7.04 year maturity were rejected while the 9.04 year maturity of 15 March 2025 fetched a weighted average of 9.01%, reflecting an increase of three basis points against its previously recorded aver age.

age.

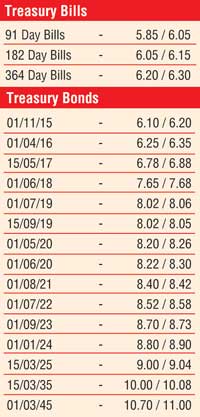

In secondary Bond markets yesterday, yields on the liquid maturities of 1 June 2018, 15 September 2019, 1 May 2020 and 1 August 2021 closed the day broadly steady subsequent to trading within daily lows of 7.65%, 8.02%, 8.25% and 8.40% respectively against its highs of 7.67%, 8.04%, 8.28% and 8.45%.

However, yields on the 1 July 2022, 1 September 2023 and 15 March 2025 maturities were seen increasing to intraday highs of 8.55%, 8.73% and 9.02% respectively following the outcome of the bond auction against its daily lows of 8.50%, 8.69% and 8.98%. In contrast, buying interest on the 20-year maturity of 15 March 2035 saw its yields dip to intraday lows of 10.05% against its days opening highs of 10.15%.

Meanwhile, today’s weekly Treasury bill auction will have on offer an total amount of Rs. 20 b, consisting of Rs. 4 b on the 91-day bill, Rs. 6 b on the 182-day bill and Rs. 10 b on the 364-day bill. At last week’s auction, weighted averages declined across the board to 6.10%, 6.22% and 6.31% respectively as its total accepted amount hit a 97-week high of Rs. 38.80 billion.

Meanwhile overnight call money and repo rates remained mostly unchanged to average 6.12% and 5.78% respectively as surplus liquidity remained high at Rs. 126.10 b yesterday.

Rupee on spot contracts dip

The rupee on spot contracts was seen dipping to a low of Rs. 133.50 once again yesterday. However, active three month forward contracts were seen closing mostly unchanged at levels of Rs. 136.30/40. The total USD/LKR traded volume for the previous day (18 May 2015) stood at $ 90.85 million.

The six month forward dollar rate that prevailed in the market was 137.80/20.