Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 16 January 2017 00:05 - - {{hitsCtrl.values.hits}}

Foreign outflow in rupee bonds hits a 42 week high

By Wealth Trust Securities

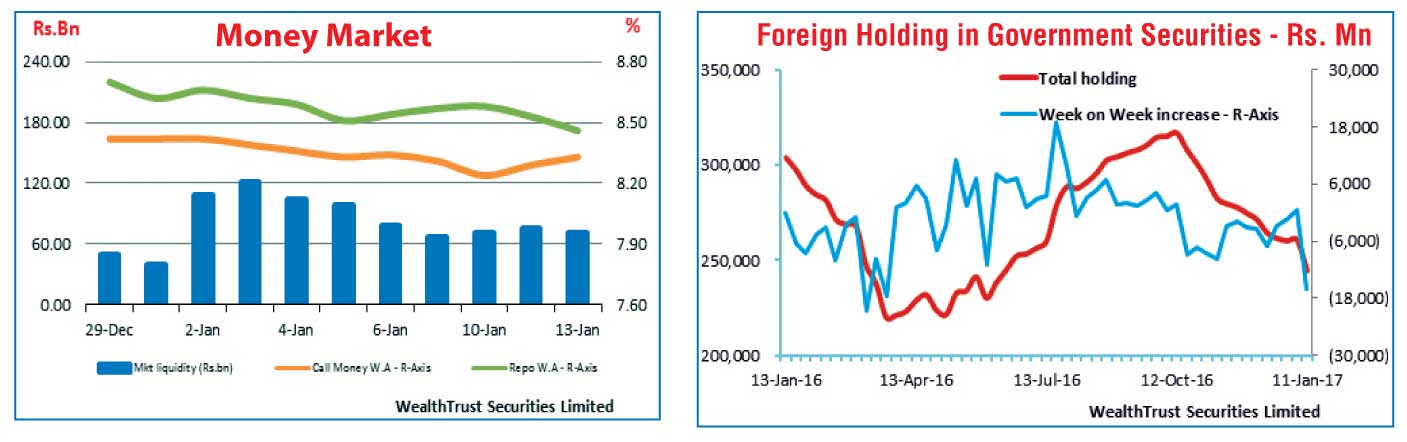

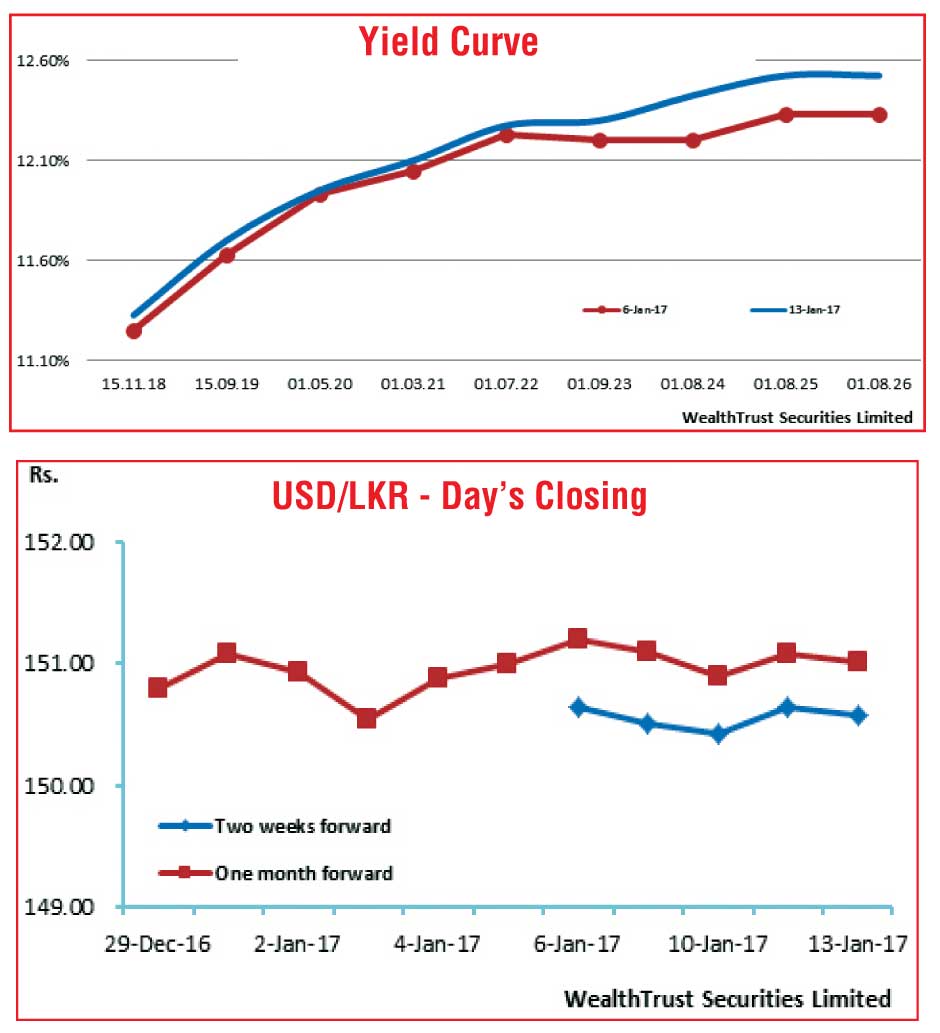

Secondary market bond yields increased during the week ending 13 January with the weighted averages at the primary auctions conducted during the week too reflecting an upward trend.

At the Treasury bond auction, the weighted averages of the 7.07 year maturity of 01.08.24 and the 9.07 year maturity of 01.08.26 increased by 18 and 10 basis points respectively to 12.16% and 12.21% while the new 2021 maturity of 15.12.21 recorded a weighted average rate of 12.16% against the previously auctioned 2021 maturity of 01.03.21’s 11.94%. Thereafter, the weighted averages at the weekly Treasury bill auction continued to increase for the sixth consecutive week.

In the secondary market, yields of the liquid maturities of 15.01.2019, 01.08.2021, 15.10.2021, 01.08.2024 and 01.08.2026 increased to weekly highs of 11.55%, 12.25%, 12.30% and 12.45% each respectively with activity decreasing towards the later part of the week.

Foreign selling of rupee bonds, which persisted throughout the week, mainly consisting of the liquid 2018 maturities (i.e. 01.06.18 and 15.11.18) at highs of 11.30% added to the momentum of rising rates. The foreign holding in Rupee bonds recorded a forty two week high outflow to the value of Rs. 16.06 billion for the week ending 11 January 2017.

In money markets, the OMO (Open Market Operations) Department of the Central Bank of Sri Lanka continuously drained out liquidity by way of overnight repo auctions at weighted averages ranging from 7.40% and 7.45% with the net surplus liquidity in the system standing at Rs. 71.42 billion. The overnight call money and repo rates averaged 8.29% and 8.54% respectively during the week.

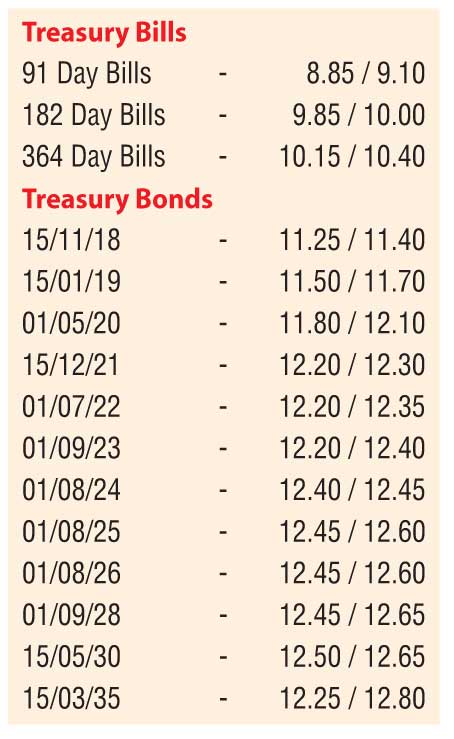

Rupee fluctuates during the week

The active two week and one month forward dollar/rupee contracts were seen appreciating to levels of Rs. 150.35/50 and Rs. 150.85/95 respectively against its previous weeks closing levels of Rs. 150.60/70 and Rs. 151.15.25, before losing once again towards the later part of the week to close at Rs. 150.55/60 and Rs. 150.98/05.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 61.24 million.

Some of the forward dollar rates that prevailed in the market were three months – 152.60/70 and six months – 154.80/00.