Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 15 June 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

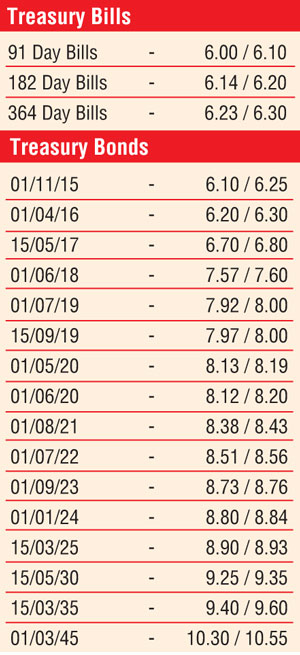

The secondary bond market witnessed heavy volatility during the week ending 12 June, despite the bond auctions conducted during the week drawing very positive outcomes. Foreign selling in rupee bonds throughout the week on the liquid maturities of 01.07.2022, 01.09.2023 and 01.01.2024 drove its yields up to weekly highs of 8.56%, 8.80% and 8.93% respectively while yields on the 01.06.2018, 15.09.2019, 01.08.2021 and 15.03.2025 maturities increased to weekly highs of 7.63%, 8.03%, 8.46% and 8.98% respectively.

The week witnessed six bond auctions during the week, two each from the 4.10 year maturity of 01.05.2020, the 7.03 year maturity of 01.10.2022 and the 9.09 year maturity of 15.03.2025. The first of the 01.05.2020 auction saw its weighted average (W.Avg) dip by 24 basis points to 8.11% against its previously recorded average while all bids for its second auction were rejected. The first and second of the 01.10.2022 auction recorded the identical W.Avg of 8.56%. The first of the 15.03.2025 auction saw all bids been rejected while second time around it recorded a robust W.Avg of 8.89%. The total accepted amount on all six auctions was seen exceeding the total offered amount of Rs. 39 billion by Rs. 8.60 billion.

The outcome of the auctions led to substantial buying interest by local participants during the latter half of the week. This intern saw yields on the liquid maturities of 01.06.2018, 15.09.2019, 01.08.2021, 01.07.2022, 01.09.2023, 01.01.2024 and 15.03.2025 dip to weekly lows of 7.58%, 7.98%, 8.38%, 8.52%, 8.70%, 8.80% and 8.85% respectively on the back of considerable volumes changing hands.

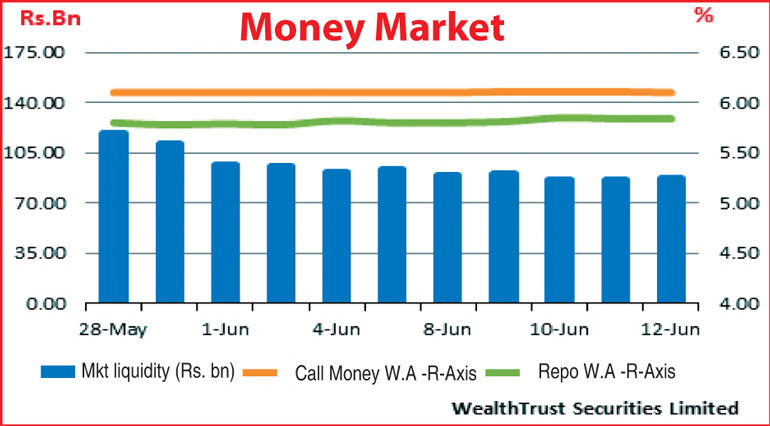

Meanwhile, the overnight call money and repo rates remained steady throughout the week ending 12 June to average 6.11% and 5.83% respectively as surplus liquidity in the market remained steady at Rs. 88.29 billion.

Rupee loses ground during the week

The importer demand coupled with foreign selling in rupee bonds saw the rupee on spot contracts depreciate during the week to close the week at Rs. 134.00 against its previous weeks closing of Rs. 130.90, subsequent to appreciating to an intra-week high of Rs. 133.80.