Saturday Feb 28, 2026

Saturday Feb 28, 2026

Saturday, 14 November 2020 00:02 - - {{hitsCtrl.values.hits}}

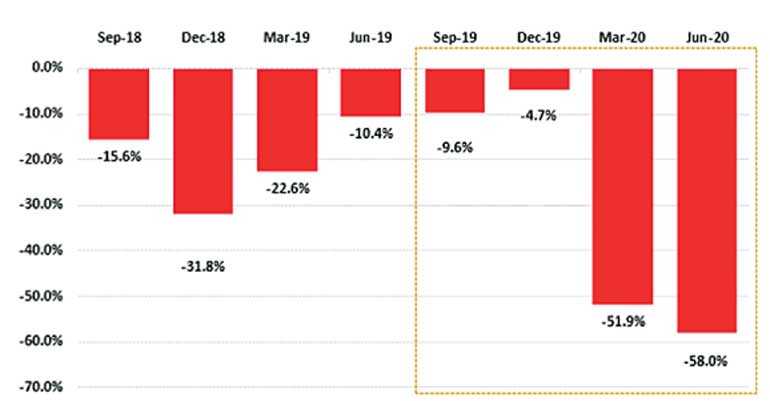

First Capital Research yesterday said second quarter recurring earnings mirrored previous quarters by declining 58.0% YoY for 267 companies but Transportation and Materials sectors outperformed expectations.

Releasing their latest analysis First Capital Research said on a recurring basis, June 2020 quarter earnings dipped by 58.0% YoY to Rs. 17.7 billion, primarily owing to sluggish performance in Diversified Financials (-97% YoY), Capital goods (-471% YoY), Consumer Services (-108% YoY), and Real Estate (-84% YoY) sector earnings.

However, negative performance of above-mentioned sectors was negated by the earnings growth in Transportation (+1043% YoY) and Materials (+60% YoY) sectors. Total earnings for the quarter, without adjustments registered a decline of 36.5% YoY as it included a one-off gain pertaining to LOLC. LOLC’s profitability spiked by 137% YoY as it included a one-off gain recognised from the sale of 70% of its stake. This transaction also resulted in Diversified Financials sector earnings boosting by 55%, although on a recurring basis, the sector recorded a profit decline of 97% YoY. Diversified Financials, Capital Goods and Consumer Service sector counters shattered the quarterly earnings, First Capital Research went onto say. On a recurring basis, Diversified Financials sector earnings dipped by 97% YoY largely led by Central Finance Company CFIN (-79% YoY) and LOLC Finance LOFC (-91% YoY).

CFIN’s profits declined as a result of drop in NII and rise in impairments. LOFC’s bottom line fell as a result of the spike in impairment to Rs. 5.7 billion. In the Capital Goods sector, John Keells Holdings became the negative contributor incurring a loss of Rs. 1.6 billion (-267% YoY) compared to Rs. 994 million profits in 1Q FY20 mainly due to the significant loss in the leisure sector of Rs. 2.5 billion resulting from the hotel closure due to COVID-19.

Moreover, Softlogic Holdings SHL made a loss of Rs. 2.4 billion (-230% YoY) compared to a loss of Rs. 753 million in 1Q FY20 led by losses made in its Retail and Telecommunication, Financial Services and Leisure and Property sectors. Consumer Services sector earnings dipped primarily led by significant losses in two key players, John Keells Hotels KHL amounting to Rs. -1.7 billion (-297% YoY) and Aitken Spence Hotel Holdings AHUN amounting to a similar loss of Rs. -1.7 billion (-292% YoY). Real Estate sector earnings plunged owing to the profit dip in EAST to Rs. 135.5 million (-95% YoY) amidst the significant reduction in finance income.

Transportation sector witnessed a profit surge of 1043% YoY to record Rs. 1.7 billion with EXPO thriving in its freight forwarding business with logistics solution for PPE skyrocketing in demand amidst the COVID-19 pandemic. Materials sector earnings were supported by improved performance in Dipped Products DIPD (+501% YoY), Haycarb PLC HAYC (+156% YoY), CIC Holdings (+262% YoY) and Tokyo Cement TKYO (+26% YoY).