Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 5 May 2020 01:06 - - {{hitsCtrl.values.hits}}

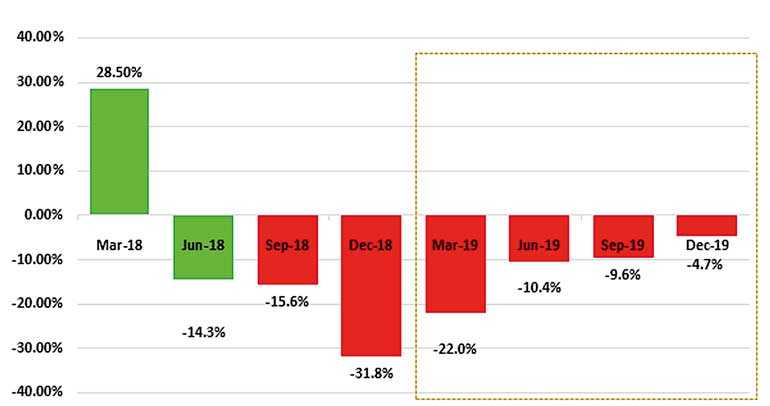

Fourth quarter (4Q) earnings in 2019 declined by 4.7% year-on-year (YoY) for 266 companies, resulting in a drop to Rs. 66.6 billion, primarily owing to sluggish performance of a number of key sectors, First Capital Research said yesterday.

Declines were recorded in the Food, Beverage and Tobacco (-35% YoY), Insurance (-41% YoY), and Capital Goods (-23% YoY) sectors. However earnings upside was witnessed in Banks (+17% YoY), Telecommunication (+259% YoY), Materials (+101% YoY), and Diversified Financials (+3% YoY), negating the negative performance in the above mentioned sectors, First Capital Research said.

Lacklustre performance in the Food, Beverage and Tobacco, Insurance, and Capital Goods sectors was mainly owing to the lower consumer spending stemming from subdued economic growth. Profit dip in Ceylon Tobacco Company (CTC) was due to successive tax hikes affecting volumes, which resulted the

-24% YoY in earnings, while Browns Investment Ltd. recorded a dip of -195% YoY mainly due to a rise in cost of production and administration. Melstacorp earnings declined by -20% YoY in line with the dip in finance income, and Nestle Lanka dipped by -17% YoY along with the weakened consumer demand and rise in cost of sales.

Led by the above counters, the Food, Beverage and Tobacco sector recorded a decline of 35% YoY. The dip of 41% YoY in the Insurance sector earnings was primarily driven by Ceylinco Insurance by -15% YoY and Janashakthi Insurance by -98% YoY (due to rise in benefits, claims and expenses); in addition, HNB Assurance recorded a decline of 66% YoY (due to the previous year recording a tax reversal).

John Keells Holdings recorded a downturn in earnings of -50% YoY primarily due to the leisure sector still harbouring the impact of the Easter Sunday attacks, exchange losses on its foreign currency denominated cash holdings compared to the previous year, and lower finance income as a result of the deployment of cash in new investments leading to a -23% YoY decline in Capital Goods sector earnings.

The Banking sector witnessed a profit growth of 17% YoY to record Rs. 23 billion, primarily driven by HNB (+28% YoY) and SAMP (+29% YoY). HNB and Sampath Bank profits were boosted due to the fall in impairments by 48% YoY and 21% YoY, respectively.

The Telecommunication sector recorded a growth of 259% YoY mainly due to Dialog Axiata PLC recording an earnings growth of 2538% YoY, primarily driven by the foreign exchange gain compared to the heavy exchange loss incurred in the previous year.

The Material sector presented a growth of 101% YoY in profits as a result of Tokyo Cement Company, which posted earnings of Rs. 257 million relative to the Rs. 174.5 million loss posted in December 2018 and improved performance in Chevron Lubricants led by strong top line growth of 15% YoY.

The Diversified Financials sector posted a growth of 3% YoY with LOLC, LB Finance and People’s Leasing and Finance Company posting earnings growth of 13% YoY, 27% YoY and 6% YoY, respectively, while earnings were supported by the strong net interest margin (NIMs).