Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 2 August 2024 00:28 - - {{hitsCtrl.values.hits}}

After suffering its worth month to date in July, the Colombo stock market began August on a positive note though investor sentiment remains beleaguered judging by low turnover.

After suffering its worth month to date in July, the Colombo stock market began August on a positive note though investor sentiment remains beleaguered judging by low turnover.

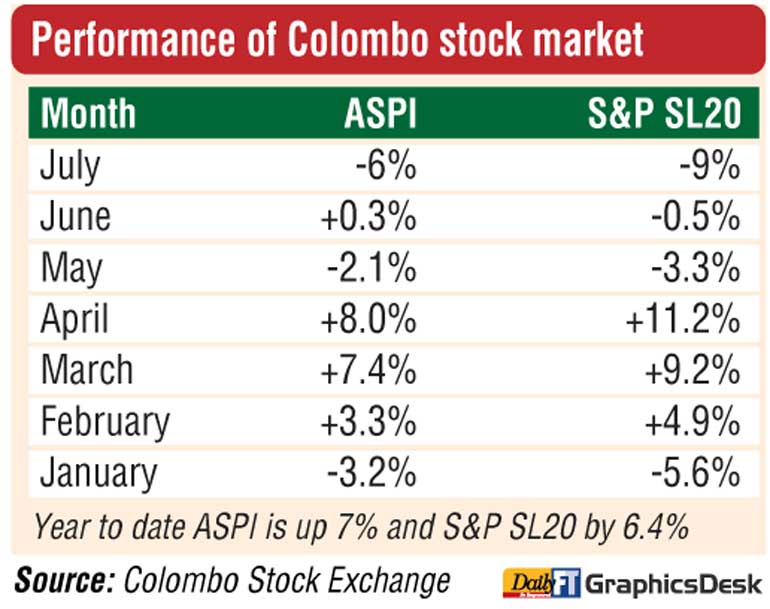

After five days of losses, the active S&P SL20 gained by 0.5% and the benchmark ASPI by 0.3% yesterday. This was after July saw worst performance with ASPI down 6% and S&P SL20 by 9%.

Turnover yesterday was Rs. 576.7 million involving 25 million shares.

Top blue chip John Keells Holdings PLC saw a recovery yesterday with its share price gaining y Rs. 3.50 or 2% to Rs. 175.25. On Wednesday Rs. 26 billion in value was wiped off JKH as investors reacted negatively to the 1 for 10 Rights Issue at Rs. 160 each raising Rs. 24 billion.

NDB Securities said high net worth and institutional investor participation was noted in Hayleys Fabric, Teejay Lanka and Sampath Bank. Mixed interest was observed in John Keells Holdings, Capital Alliance and Citizens Development Business Finance whilst retail interest was noted in Browns Investments, Dialog Axiata and LOLC Finance.

Foreign participation in the market activity remained at subdued levels with foreigners closing as net buyers.

The Capital Goods sector was the top contributor to the market turnover (due to John Keells Holdings) whilst the sector index gained 1.12%. The share price of John Keells Holdings increased by Rs. 3.50 to Rs. 175.25.

The Consumer Durables and Apparel sector was the second highest contributor to the market turnover (due to Teejay Lanka and Hayleys Fabric) whilst the sector index increased by 1.82%. The share price of Teejay Lanka gained 50 cents to Rs. 40.50. The share price of Hayleys Fabric moved up by Rs. 2 to Rs. 48.00.

Sampath Bank and Capital Alliance were also included amongst the top turnover contributors. The share price of Sampath Bank recorded a gain of 60 cents to Rs. 75.50. The share price of Capital Alliance appreciated by Rs. 1.90 to Rs. 44.40.