Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 5 February 2018 00:00 - - {{hitsCtrl.values.hits}}

By Skandha Gunasekara

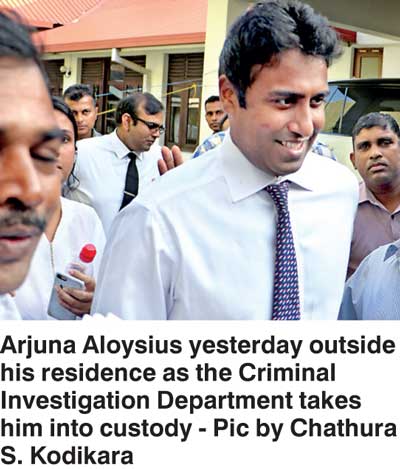

The owner of Perpetual Treasuries Ltd. Arjun Aloysius and its Chief Executive Officer Kasun Palisena were taken into the custody of the Criminal Investigation Division yesterday in connection with the Central Bank bond scam.

According to Police Spokesperson SP Ruwan Gunasekara, Police and CID officers surrounded the houses of Aloysius and Palisena before making the arrests in the early hours of last morning.

“By around 8.30 a.m. both Aloysius and Palisena were in CID custody,” the Police spokesman said. At the time of writing, both suspects were being questioned by the CID at the CID headquarters in Fort.

“The CID will take down the statements of the two suspects and then have them appear before courts,” SP Gunasekara said, adding that the suspects would be produced before the Fort Magistrate Court today.

The CID on Friday filed a B report at the Fort Magistrate Court over the Central Bank Bond scandal naming Arjun Aloysius, Kasun Palisena and former Central Bank Governor Arjuna Mahendran as suspects in the case.

Following a request by the CID, Fort Magistrate Lanka Jayaratne issued an order directing the Controller General of the Emigration and Immigration Department to impose a travel ban on the three suspects.

In addition, the Fort Magistrate also issued a directive ordering Mahendran to appear before the CID and make a statement by 15 February.

Meanwhile, Palisena in a recent letter addressed to all Parliamentarians denied the company’s involvement in the Treasury bond transactions had caused losses to state entities while claiming that the sale of the Treasury bonds by Perpetual Treasuries to the Employees Provident Fund, the Sri Lanka Insurance Corporation and the National Savings Bank had in fact created returns in excess of Rs. 25 billion ($ 164 million).

Parliament is scheduled to meet tomorrow to hold the bond report debate.

The arrests come a month after President Maithripala Sirisena said a panel had recommended legal action against the Finance Minister, former Central Bank Governor and the owner and officials of Perpetual Treasuries.

Sirisena said the presidential commission of inquiry had concluded that Perpetual Treasuries had profited through illegal means.

Mahendran, Aloysius and Perpetual Treasuries have denied any wrongdoing.

Centre for Human Rights claims Perpetual Treasuries’ report to MPs fraudulent

The Centre for Human Rights yesterday charged that the financial report contained within the letter sent out by Perpetual Treasuries CEO Kasun Palisena to all parliamentarians was fraudulent and that just seven transaction out of the total had caused a loss of Rs. 25 billion.

Centre for Human Rights Executive Director Rajith Keerthi Tennakoon told the Daily FT that while the financial report compiled by Palisena featured false details, the serial number included had been invaluable in deciphering the actual values of the transaction carried out by Perpetual Treasuries.

“There are close to 30 serial numbers in Palisena’s report. These are the serial numbers of 30 transactions where Perpetual Treasuries bought bonds from the Central Bank and sold them to the Employees Provident Fund, Sri Lanka Insurance Corporation and the National Savings Bank (NSB). We have analysed seven transactions and found a loss of Rs. 26 billion to the State,” Tennakoon said, noting that both the Attorney General’s Department and the Presidential Commission of Inquiry into the Bond Scam had not been privy to the serial numbers of the transactions.

Tennakoon went on to note that the Centre for Human Rights would be analysing the remaining transactions to ascertain the total loss to the country.