Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 4 November 2024 03:35 - - {{hitsCtrl.values.hits}}

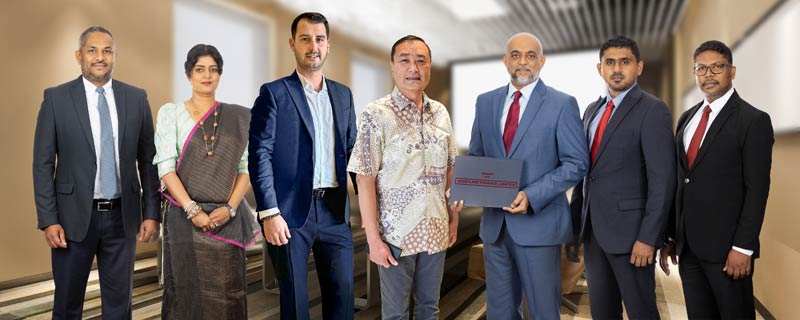

From left: Regiis Capital Managing Director Udara BentharaArachchi, Founding Partner Amarasi Gunasekara, Schroders Group Member and BlueOrchard Finance AVP/Senior Investment Officer – Origination and Structuring Lado Jobava, Origination Asia Head Lee Yan Kit, AFL Director and CEO Ashan Nissanka, General Manager – MIS, Planning and Analysis Feroze Ahamed, and General Manager – Finance and Accounting Rengasamy Rajeshkumar

In a groundbreaking development, Assetline Finance Ltd. (AFL), the flagship company in the financial services cluster of David Pieris Holdings Ltd., one of Sri Lanka’s top conglomerates, has secured a senior loan from the Japan ASEAN Women Empowerment Fund (JAWEF) managed by BlueOrchard Finance Ltd., a leading global impact investment manager.

This loan marks several significant milestones, both for Assetline Finance and for the non-banking financial institution (NBFI) sector in Sri Lanka.

This transaction is particularly noteworthy as it represents the first fresh loan disbursed to an NBFI by an international lender in the post-COVID environment among many rollover facilities of existing exposures in Sri Lanka. This also signifies the first international loan received by AFL. The company’s ability to secure international funding from a globally renowned impact investment manager such as BlueOrchard independently endorses AFL’s financial resilience and the commitment for growth trajectories such as empowering women.

AFL has been playing a substantial role in bridging the gap between female entrepreneurs and financial inaccessibility of rural women in Sri Lanka. ‘‘Liyadiriya’’, a bespoke product for today’s woman, is an initiative, with a special emphasis on cottage industries and home-based ventures pioneered by AFL.

This product is particularly impactful in the North and East, where female-led entrepreneurship has increased.

By fostering financial literacy and technical know-how, Assetline’s tailor made programs not only provide women with the tools needed to grow their businesses but also create sustainable employment opportunities within their communities.

The “Deshayata Jawayak” program, along with safe riding workshops and skills training undertaken by AFL and the David Pieris Holdings, inspired women to gain confidence in their mobility in a safe manner, allowing them to balance their versatile roles providing meaningful opportunities, thus promoting financial inclusion, stability, and independence.

Reflecting on this significant transaction, AFL Director and CEO Ashan Nissanka stated: “We are proud to engage in a strategic collaboration with BlueOrchard, a leading global impact investment manager. This partnership goes beyond funding—it represents a long-term relationship that focuses on capacity building, knowledge sharing, and impactful financing. Together, we are not only strengthening our mission to empower women entrepreneurs and promote financial inclusion but also fostering sustainable growth for communities across Sri Lanka, thereby actively contributing towards the economic growth of the country.”

Regiis Capital acted as the financial intermediary for this transaction, facilitating the successful conclusion of the deal. Regiis Capital, known for its expertise in structuring and advising financial transactions, continues to support growth-oriented institutions in accessing international funding opportunities.

“This transaction is significant in many facets; it is timely as Sri Lanka is in a strong development phase against all odds, it is purposeful as it nurtures the most significant yet understated segment of budding entrepreneurs -women, it reflects the financial resilience and impact commitment of Assetline Finance and above all, it is a classic example of a catalyst with a true development mandate in heart such as BlueOrchard, to come forward and play the part when it’s needed the most,” says Regiis Capital Founding Partner Amarasi Gunasekara.

BlueOrchard, known for its global leadership in impact lending, has clearly demonstrated its commitment to supporting development in emerging markets, especially during challenging economic conditions with their calculated risk-based investment approach and strategic vision in impact investment.

Adding their thoughts on this transaction BlueOrchard Finance Ltd. Chief Credit Officer Normunds Mizis said: “It is our pleasure to collaborate with Assetline Finance to further empower women entrepreneurs in Sri Lanka. What is impressive to note is that AFL already has a 25% of their portfolio with female clientele and with the assistance of BlueOrchard, plans to significantly grow this portfolio in the next three years to promote gender equality and women empowerment. We trust this will be the beginning of a long and meaningful relationship between BlueOrchard, AFL, and the David Pieris Group.”