Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 18 December 2023 01:31 - - {{hitsCtrl.values.hits}}

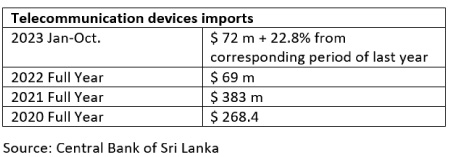

A group of authorised mobile phone importers in Sri Lanka has expressed their deep concern over the Government’s decision to remove mobile phones from the Value Added Tax (VAT) exemptions list, coupled with a simultaneous increase in VAT from 15% to 18%, effective 1 January 2024.

A group of authorised mobile phone importers in Sri Lanka has expressed their deep concern over the Government’s decision to remove mobile phones from the Value Added Tax (VAT) exemptions list, coupled with a simultaneous increase in VAT from 15% to 18%, effective 1 January 2024.

They said the dual impact, wherein devices now not only face a sudden VAT imposition, but also at a significant rate of 18%, pose substantial challenges for the industry and the country. The importers urgently call for a critical reassessment by the authorities in light of these compounded challenges.

The timing of the VAT hike is particularly challenging for authorised mobile phone importers in the country. These companies have collaborated with the Telecommunications Regulatory Commission of Sri Lanka (TRCSL) to find viable solutions to the challenges of parallel imports. Parallel imports, or grey market goods, involve the import and sale of branded products in a market without the trademark owner’s consent. This issue has already caused a tax revenue loss of Rs. 3.1 billion ($ 9.4 million) and a forex outflow of Rs. 31.6 billion ($ 96 million) via illegal channels in Sri Lanka.

With the sudden VAT increase, this loss is estimated to rise to Rs. 11.9 billion, marking a substantial increase in tax revenue loss from illegal imports. Additionally, there is a projected further tax revenue loss to the Government, amounting to a Rs. 2.5 billion decline from legitimate imports. This decline is anticipated due to increased parallel import products driven by the rising prices of genuine products.

Moreover, the ramifications extend beyond the economic landscape. Over 10,000 direct job opportunities are now at risk, leaving families dependent on the industry, more than 15,000, including those involved in logistics, printing, branding, advertising, etc., facing uncertainty. The policy change also jeopardises direct forex investment for market development by principals (ATL/BTL), putting this crucial financial support at risk. Furthermore, the spectre of a national security threat looms as parallel imports introduces unknown devices to the country, creating challenges in tracking these products.

Authorised mobile importers emphasise the unfortunate timing of removing cellular and electronic devices from the VAT-exempted list and the hike in VAT given the ongoing efforts by legal importers to find solutions for the persistent Parallel Imports (PI) issue.

The industry had put forward practical suggestions and is actively engaged in collaboration with the TRCSL to explore viable solutions which include proposing an option for registering already in-use PI devices at a nominal fee, introducing a Tourist SIM for the duration of the incoming visitor’s Visa period, and implementing whitelisting of non-registered IMEI from mobile networks. These initiatives aim to holistically address the challenges posed by parallel imports, foster regulatory compliance, and contribute to the development of effective policies that strike a balance between industry interests and regulatory requirements. However, the sudden imposition of VAT, and at an alarmingly high percentage while the industry was working with the TRCSL, is deeply concerning. Similar situations have been observed in countries like Pakistan and Nepal.

The absence of effective measures to restrict parallel imports before imposing taxes impacts legitimate imports and results in a substantial loss in Government revenue. Authorised mobile importers stress the critical necessity for the Government to prioritise and implement a viable solution for the parallel import problem before imposing additional taxes on the industry. This approach is urgent and essential to safeguard the industry’s interests and the Government’s fiscal well-being.

On 1 December 2023, a meeting was convened involving the TRCSL, leading mobile brands and authorised importers. The assembly of mobile importers present included Thushara Ratnaweera and Chaminda Silva representing Samsung, alongside Rajeev Gooneratne and Charles Wijesuriya from Gnext, Prasanna Weerakoon of JKOA, Chathura Jayawardena and Sha Bulathsinhala from Abans, and Gurubaran and Sanketh Gihan representing Vivo.

Having raised these concerns with the TRCSL and actively working on possible solutions for Parallel Import (PI) imports before the VAT announcement, authorised mobile importers in Sri Lanka urgently call upon the Government to reconsider and postpone the removal of cellular devices from the VAT exempt list until a comprehensive solution for the PI problem is sought and implemented.

The importers reiterate that they remain committed to collaborative efforts with the Government to find a balanced resolution, ensuring a beneficial outcome for both parties and the citizens of the country.