Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 11 December 2024 00:29 - - {{hitsCtrl.values.hits}}

By Janani Kandaramage

By Janani Kandaramage

The country’s book industry yesterday renewed its call to cancel the prohibitive 18% Value-added tax (VAT), with four industry bodies submitting a proposal to the new NPP Government for inclusion in the next national Budget.

In their proposal, the four associations representing publishers, writers, retailers, importers and exporters as well as academics and stakeholders voiced their opposition to the unavoidable price hike consequent to the imposition of VAT, urging the Government to consider the financial and social ramifications of taxing sources of knowledge and learning.

These associations stressed that with all inputs for the publishing industry being imported with the exception of local labour, the book industry already faces a hefty burden of 33.045% that is exacerbated with the introduction of VAT at 18%. Calling for books to be exempt from tax, as was the case prior to January 2024, aims to avert long-term consequences of books being unaffordable to the masses and driving small-scale publishers out of business.

Before 2024, books were not subject to VAT. As per the 1950 Lawrence agreement, it was agreed that there should be no taxes on intellectual property, and the enforcement of this tax has violated this agreement. Former President Ranil Wickremesinghe claimed that the VAT was vital in strengthening government revenues, proving that the country was capable of settling its debts. Nevertheless, he had assured associations of his robust commitment towards lifting the VAT on books during his tenure.

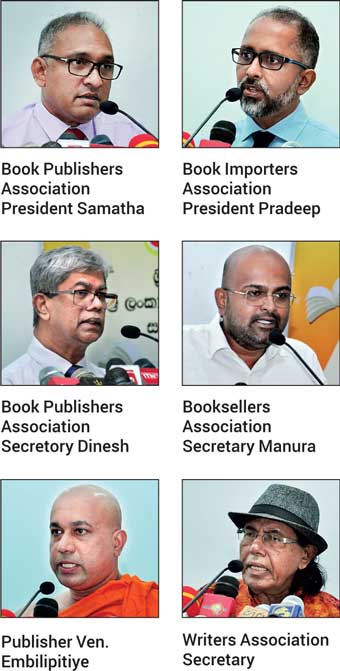

Sri Lanka Book Publishers Association (SLBPA) President Samantha Indeewara pointed out that representatives of the new Government while in the Parliamentary Opposition had been heavily critical of the VAT on books, raising hopes that concerns of the book industry would be addressed in the next budget.

“We have brought to the Government’s attention the numerous anomalies affecting the industry that are directly attributable to the imposition of VAT on books,” he said. “This includes the fact that the majority of publishing companies are not eligible to pay VAT, and therefore are unable to deduct the VAT they pay on inputs for locally produced books, or the VAT they pay on the imports. To be eligible for VAT, a company must have an annual turnover of Rs. 60 million. Only 12 large publishing and printing companies are eligible to pay VAT on their sales and can therefore deduct the VAT they pay on inputs.”

Speaking about the impact on small scale publishers, Indeewara said: “Many of the small publishers sell their books via the bookshops and distribution networks of large companies, and the imposition of tax results in all of their books being taxed because they lack the ability to claim the VAT and compete with other established publishers due to little price making power.”

Another concern cited was that with the indiscriminate extension of VAT to a highly sensitive and vulnerable sector like books, Sri Lanka was also in violation of the UNESCO Florence Agreement of 1950, to which the country was an early signatory and continues to be a Contracting State. The UNESCO Florence Agreement is a treaty that binds Contracting States to not impose customs duties and taxes on certain educational, scientific, and cultural materials that are imported.

“With the imposition of VAT on books, Sri Lanka attains the dubious distinction of becoming the only country in Sri Lanka, where VAT is imposed on VAT,” said Publisher Ven. Embilipitiya Vijitha Thero. “Apart from the writer the rest of the production is dependent on raw materials which are imported and subject to levies and taxes in addition to the final stage of sales VAT as well. Raw material, printing and sales are all subject to VAT, leading to massive surges in the price of books. This is detrimental to younger generations as reading is not freely available, inhibiting the overall knowledge of the country in the future. The current Government is focused on economic advancement, but they must understand that economic advancement will remain a dream unless efforts aimed at promoting the access of books are made.”

It was also added that 10,000 jobs were at risk within the industry, as many large-scale producers struggle to retain their workforce, increase salaries, and pursue new investments due to overwhelming costs. All Ceylon Booksellers Association Secretary Pradeep Samaranayake noted that this was because of the way tax has accumulated, stating that “VAT is applied by adding a 10% margin to the Cost, Insurance, and Freight (CIF) value. For example, if the total value of an import is 100, the 10% margin is added first, and then VAT is calculated on that total. Additionally, the social security levy is also applied to this adjusted value. Altogether we pay around 33.045% when importing books. In the first 6 months of 2024, a survey among our members showed a 17% decrease in the sale of books compared to the same period in 2023. This drop is largely due to high prices, exchange rate fluctuations, and VAT. This decline is alarming as it indicates a reduction in reading habits, indicating a fall in sales of books and therefore lowered revenue despite rising costs. This will inevitably place huge pressure on businesses to resort to cost-cutting practices.”

SLBPA Secretary Dinesh Kulatunga described the conference as a unified stand by the industry against the imposition of VAT on books, highlighting its potential to cause significant long-term socioeconomic repercussions. He emphasised that such a tax would hinder access to knowledge about Sri Lanka’s history, culture, and traditions, stifle creative expression, and escalate the cost of education, potentially forcing some book businesses to shut down.

Associated with the SLBPA and joint signatories to the proposal submitted to the Government were the Sri Lanka Writers Association, the All Ceylon Booksellers Association, and the Sri Lanka Book Importers and Exporters Association.