Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 3 January 2025 00:32 - - {{hitsCtrl.values.hits}}

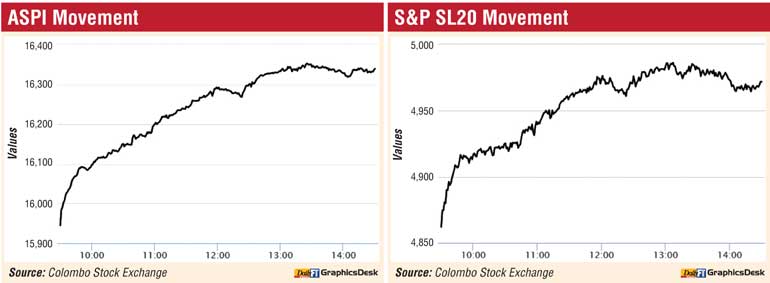

Enjoying its all-time-high, the Colombo Stock Market yesterday began 2025 in a sensational fashion with nearly Rs. 13 billion turnover involving over a half billion traded shares with indices up over 2% as investors turned more bullish on the first trading session in the New Year.

Coming off a 50% gain and second best regional performer status in 2024, the Colombo Stock Market produced by far the best New Year openings in recent years. The market also saw net foreign inflow. The benchmark ASPI gained by 2.5% or 404 points thereby crossing the 16,000-point mark and the active S&P SL20 by 2.2%.

Turnover was Rs. 12.8 billion involving 541.6 million shares.

First Capital said most of the investor attention was focused on Blue-chip stocks and Banking sector shares. Additionally, JKH, BIL, SAMP, SPEN and LOLC emerged as the top positive contributors to the index. It said there were multiple off-board transactions and increased participation from retail investors.

The Banking sector led the turnover by 27%, followed by the Capital Goods and Food, Beverage and Tobacco sectors jointly contributing 43% of the overall turnover. Turnover was dominated by JKH (Rs. 1.25 billion), Browns Investments (Rs. 1 billion), Aitken Spence (Rs. 719 million), HNB (Rs. 606.5 million) and Hemas Holdings (Rs. 529 million). JKH saw 10.8 million shares done at Rs. 23.30 via two crossings.

The net foreign inflow for the day stood at Rs. 88.6 million.

NDB Securities said the ASPI closed in green as a result of price gains in counters such as John Keells Holdings, Browns Investments and Sampath Bank.

High net worth and institutional investor participation was noted in John Keells Holdings, Aitken Spence and Hemas Holdings. Mixed interest was observed in Browns Investments, LOLC Finance and Pan Asia Banking Corporation, whilst retail interest was noted in Beruwala Resorts, Kotagala Plantations and SMB Leasing.

The Banking sector was the top contributor to the market turnover (due to Hatton National Bank) whilst the sector index gained 2.03%. The share price of Hatton National Bank recorded a gain of Rs. 5.75 to Rs. 325.50.

The Capital Goods sector was the second highest contributor to the market turnover (due to John Keells Holdings, Aitken Spence and Hemas Holdings) whilst the sector index increased by 3.70%. The share price of John Keells Holdings increased by Rs. 1 to Rs. 23.60. The share price of Aitken Spence moved up by Rs. 10.25 to Rs. 155.25. The share price of Hemas Holdings appreciated by Rs. 5.25 to Rs. 108.50.

Browns Investments was also included amongst the top turnover contributors with its share price gaining by Rs. 1 to Rs. 8.10.

The Colombo Bourse closed positive in 2024, with both benchmark indices reaching record highs, primarily driven by improved macroeconomic trends and strengthened confidence in the new mandate, as the All Share Price Index (ASPI) rose +50% YoY to 15,945 points, while the more liquid S&P SL20 index increased +58% YoY to 4,862 points.

Sri Lanka’s ASPI was the second-best performer compared to regional markets, trailing only behind Pakistan with a +50% YoY gain, according to CT CLSA Securities.