Sunday Mar 01, 2026

Sunday Mar 01, 2026

Thursday, 15 June 2023 02:22 - - {{hitsCtrl.values.hits}}

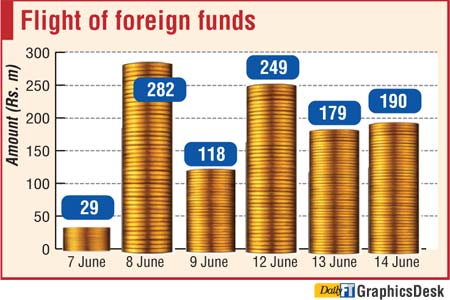

Bullish local investors continue to boost the Colombo bourse with sharp gains in indices and healthy turnover but net foreign topped the Rs. 1 billion mark just within the past six sessions.

Bullish local investors continue to boost the Colombo bourse with sharp gains in indices and healthy turnover but net foreign topped the Rs. 1 billion mark just within the past six sessions.

The active S&P SL20 gained by 2.5% and the benchmark ASPI by 1.6%. Turnover was Rs. 2.7 billion involving 123.6 million shares. Downward trend in interest rates has shifted investors to equities though the economy’s struggle persists. Investors also reverted to banking sector stocks predicting a positive outcome from yet to be announced domestic debt restructuring/optimisation.

Significantly, the ASPI has recorded a notable gain of 494 points over the last five sessions (+5.7%) while the S&P SL20 index has picked up by 171 points (+6.9%).

Asia Securities said the ASPI crossed the 9,200 level to reach a nine-week peak as banking stocks continued their upward momentum for a fifth consecutive session led by COMBN (+6.4%), SEYBN (+4.8%), NDBN (+4.5%), HNBX (+4.5%), SEYBX (+3.9%), SAMP (+1.7%), HNBN (+1.9%), DFCC (+3.2%), PABC (+1.6%), and UBC (+5.6%).

Adding to the prevailing positive sentiment in the market, the ASPI received additional backing from front-line stocks LOFC (+3.3%), LIOC (+2.0%), DIST (+2.8%), CALT (+3.5%), AGST (+4.7%), CICN (+4.4%), CICX (+5.1%), and LOLC (+7.4%).

COMB (+29 points) provided the biggest boost to the ASPI during the session, followed by LOLC (+17 points), and VONE (+12 points). The breadth of the market was strong with price gainers outnumbering decliners by a margin of 138 to 54.

Market turnover was boosted by off-board transactions in LFIN (Rs. 290 million), CARG (Rs. 220 million), JKH (Rs. 110 million), and CTHR (Rs. 133 million). Apart from these stocks, LOFC (Rs. 240 million), and HAYL (Rs. 108 million) continued to witness increased domestic investor activity during the session.

Crossings accounted for 31.3% of turnover led by LFINN (Rs. 289.7), CARGN (Rs. 219.6 million), JKHN (Rs. 110.5 million) and CTHRN (Rs. 133.2 million).

A net foreign outflow of Rs. 190 million was recorded with CARG (Rs. 237 million) being the primary contributor to net inflows and LFIN (Rs. 371 million) leading in net outflows. Month to date net foreign outflow crossed the Rs. 1 billion mark whilst the year to date figure remains positive at Rs. 310 million.

First Capital said the bourse rallied with a massive gain fuelling bullish optimism for the fifth consecutive day, surpassing and closing the day above 9,200 level after one and a half months.

Banking and NBFIs sectors continued to upsurge as investors speculated less impact on the above over DDO as interest rates are on the track of normalising.

Treasury counters too witnessed investor interest, on expectations that the weighted average yields to further trim down at the weekly T-Bill auction. Retail participation was seen strengthening and was largely led by LOLC Group of companies.

NDB Securities said high net worth and institutional investor participation was noted in Cargills, C T Holdings, and John Keells Holdings. Mixed interest was observed in LB Finance, Hayleys and First Capital Treasuries whilst retail interest was noted in LOLC Finance, Browns Investments and Blue Diamonds Jewellery Worldwide.

The Diversified Financials sector was the top contributor to the market turnover (due to LB Finance and LOLC Finance) whilst the sector index gained 3.02%. The share price of LB Finance increased by Rs. 1.80 to Rs. 56.00. The share price of LOLC Finance gained 20 cents to Rs. 6.20.

The Capital Goods sector was the second highest contributor to the market turnover (due to John Keells Holdings) whilst the sector index increased by 0.83%. The share price of John Keells Holdings recorded a gain of 50 cents to Rs. 141.75.

Cargills and C T Holdings were also included among the top turnover contributors. The share price of Cargills moved down by Rs. 2 to Rs. 250.25. The share price of C T Holdings declined by Rs. 3.50 to Rs. 180.