Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 17 May 2022 02:44 - - {{hitsCtrl.values.hits}}

The sharp hike in interest rate to severely hit the Government most as analysts estimate one percentage increase translates to Rs. 20 billion per annum.

On 3 April in the tightest ever monetary policy stance the Monetary Board decided to double policy rates by 700 basis points (7%). It justified the move saying a substantial policy response is imperative to arrest the build-up of added demand driven inflationary pressures in the economy and pre-empt the escalation of adverse inflationary expectations, to provide the required impetus to stabilise the exchange rate and also to correct anomalies observed in the market interest rate structure.

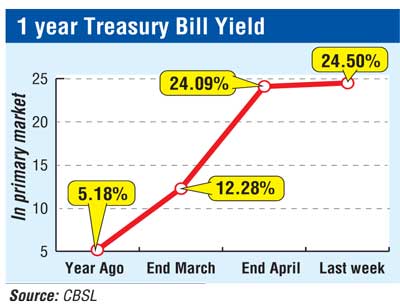

Since then, the benchmark 364-day Treasury Bill yields have doubled to 24% as of last week from 12% as at end March. From a year ago however it is a near five-fold increase.

Analysts told the Daily FT that the public debt (Treasury Bills and Bonds) is estimated at Rs. 9 trillion, the average maturity of which is four and half years. On that basis the value of such maturing public debt is Rs. 2 trillion per annum and a 10% increase in interest rate adds a Rs. 200 billion extra per annum. This works out to Rs. 20 billion per 1% increase in interest rate. Since the policy rate hike, the interest rate has risen by 12%.

On the basis of 4 and 1.2 average maturity the additional cost of debt servicing is a staggering Rs. 900 billion.

“The Government is to increase taxes such as VAT and Income Tax to raise the revenue to GDP ratio. However, any additional revenue garnered from this move gets negated due to the higher cost of debt servicing following the hike in interest rate,” analysts opined.

The next monetary policy review by the Monetary Board is due for tomorrow with an announcement on Thursday. Some analysts expect a further tightening stance. If this happens the Government's debt servicing cost will soar further, analysts warned.