Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Tuesday, 4 July 2023 01:19 - - {{hitsCtrl.values.hits}}

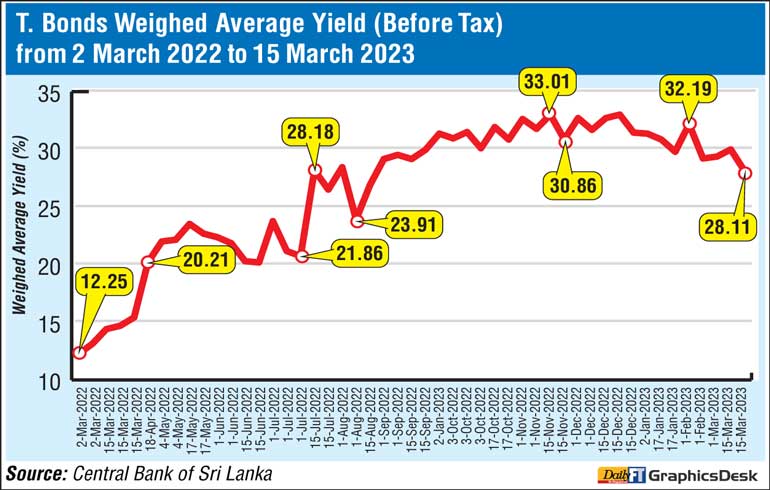

The Central Bank on behalf of the Government issued Rs. 1.4 trillion worth of Treasury Bonds between 18 April 2022 and 15 March 2023. Maturities of Treasury Bonds issued ranged from a low of 2 years and a high of 10 years. The Weighted Average Yield before tax was a high 33.01% for a two year bond issued on 15 November 2022.

Offered amount was Rs. 50 billion and Rs. 56 billion worth of bids received of which only Rs. 9 billion were accepted. A similar yield was fetched for a 2 year bond issued on 15 December 2022. Of the Rs. 67.4 billion bids received for RTs. 50 billion issue, Rs. 32.2 billion were accepted.

Prior to the CBSL increasing policy rates (by 7% in March), the WAY ranged from 12.25% (3 year bond) to 15.42% (10 year bond) for issuances in March. Thereafter the unprecedented rise began with 20.21% in April onwards.

Of the bonded-domestic debt of $ 24 billion, EPF holding of $ 8.8 billion or 36.5% is included. Banks holding $ 10.7 billion or 44.4% are excluded. Others holding $ 4.6 billion or 19.2% are excluded except for the ETF.

Asia Securities Research said the impact of the DDO on the Yield Curve (YC) is expected to be positive and significant. The following are some of the expected outcomes of the DDO on the YC: The YC will shift downwards as the DDO risk premium is eliminated for the banking sector rupee denominated bonds.

The YC will flatten or become upward sloping as the inflation rate decreases amid anticipated policy rate adjustments by the CBSL in 2H2023E. This will lower the short-term interest rates and increase the demand for long-term bonds, Asia added.

The bond exchange program is not applicable to all bond holders.

Banking Sector and Non-Bank Financial Institutions (NBFIs): They are excluded from the program to avoid systemic risks and ensure financial system stability.

Insurance Companies and Primary Dealers: They are excluded from the program to maintain market efficiency.

Private rupee-denominated Bond Holders: These are individual or corporate investors who hold rupee denominated bonds. They are also excluded from the DDO.

Bartleet Religare Securities Equity Research said the expected outcomes of the DDO include a potential decline in interest rates reducing the gap between market rates and policy rate.

It attributed two significant factors. Firstly, the reduced risk premia on government bonds from the debt restructuring measures are likely to create a more favourable environment for investors. As the perceived risk associated with government debt decreases, investors may demand lower interest rates, to a downward trend in borrowing costs.

Secondly, the current rate of inflation can also exert downward pressure on interest rates. As inflation moderates, the Central Bank will have flexibility to implement monetary policies aimed at reducing interest rates, stimulating economic growth, and encouraging investment.