Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 2 June 2023 00:24 - - {{hitsCtrl.values.hits}}

The Central Bank revealed yesterday that it had absorbed $ 1.7 billion in foreign exchange year to date of which a high $ 662 million in May thereby stabilising the Rupee.

It said this move ensured a steady increase in gross official reserves (GOR) to $ 3.1 billion of which, the usable amount is $ 1.6 billion.

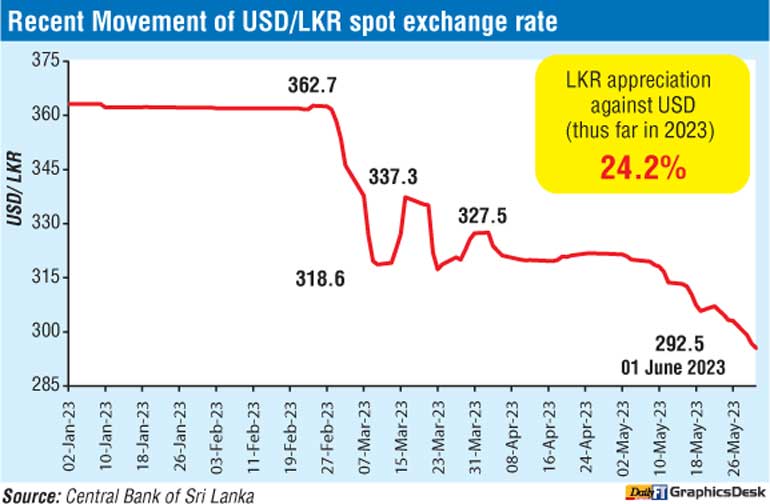

The Rupee has appreciated by 24% against the US Dollar year to date.

CBSL said reflecting the improved balance of payments (BOP) conditions, the Central Bank relaxed the cash margin deposit requirements imposed on selected imports in May 2023, and further measures will be initiated to loosen capital flow restrictions in the period ahead.

Further, the Monetary Board viewed that a gradual phasing out of the existing import restrictions would need to commence soon. The continuation of the IMF-EFF supported program, further financial assistance from international development partners, such as the Asian Development Bank (ADB) and the World Bank, and renewed investor appetite, coupled with the advances in the debt restructuring process, are expected to ease the BOP constraint significantly in the period ahead, supporting the recovery in domestic economic activity.