Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 23 December 2024 01:59 - - {{hitsCtrl.values.hits}}

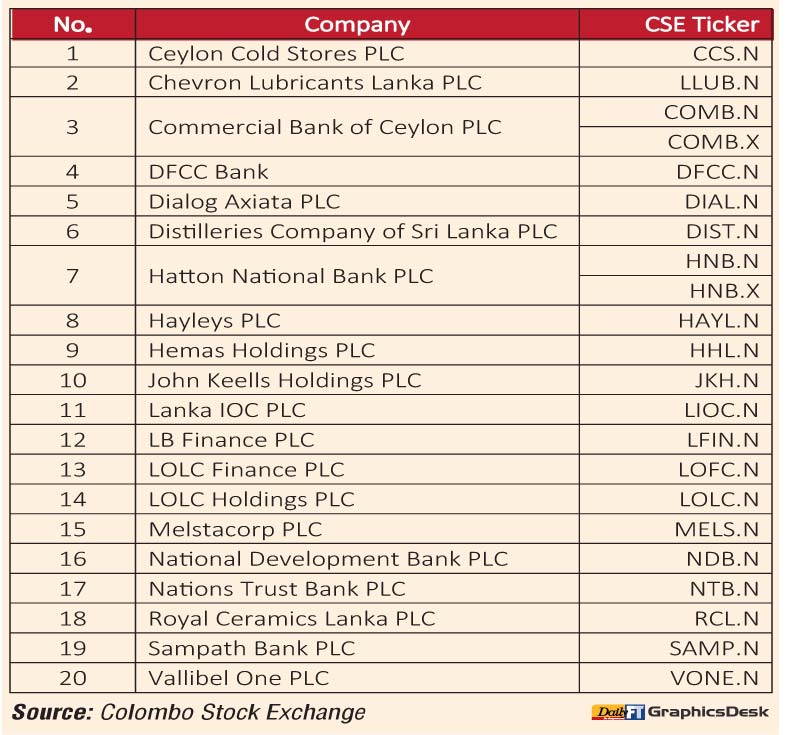

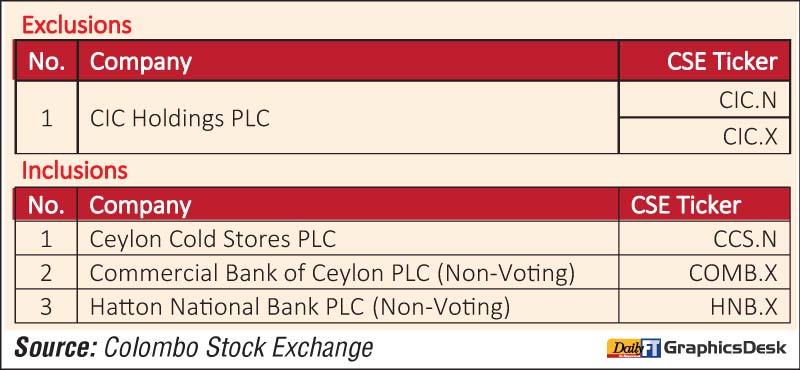

The Colombo Stock Exchange (CSE) has announced the following changes to the S&P Sri Lanka 20 index constituents as part of the 2024 Year-End Rebalance, conducted by S&P Dow Jones Indices.

The exclusions and inclusions, as announced by S&P Dow Jones Indices, will take effect from 23 December 2024, following the market close on 20 December 2024.

The S&P SL 20 index includes the 20 largest companies, by total market capitalisation, listed on the CSE that meet minimum size, liquidity and financial viability thresholds. The constituents are weighted by float-adjusted market capitalisation, subject to a single stock cap of 15%, which is employed to reduce single stock concentration.

The S&P SL 20 index has been designed in accordance with international practices and standards. All stocks are classified according to the Global Industry Classification Standard (GICS), which was co-developed by S&P Dow Jones Indices and MCSI and is widely used by market participants throughout the world.

To be eligible for inclusion, a stock must have a minimum float-adjusted market capitalisation of 500 million Sri Lankan Rupees (Rs.), a six-month median daily value traded of Rs 0.25 million and have positive net income over the 12 months prior to the rebalancing reference date.