Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 18 December 2017 00:13 - - {{hitsCtrl.values.hits}}

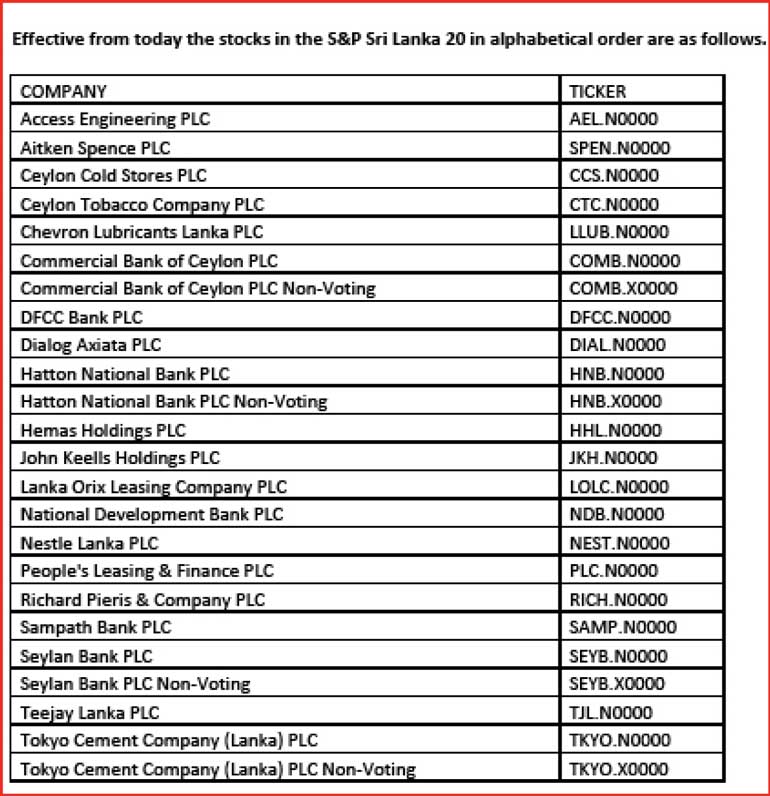

The Colombo Stock Exchange (CSE) has announced the following changes in S&P Sri Lanka 20 index constituents made by S&P Dow Jones Indices at the 2017 year-end index rebalance.

A revision of the S&P SL 20 methodology in March 2017 established the practice of a semi-annual rebalance of the index (previously conducted annually), which is set to take place during the months of June and December each year.

The revision also established the inclusion of non voting ordinary shares listed by the respective companies of the S&P SL 20 Index, provided that such shares meet relevant liquidity requirements.

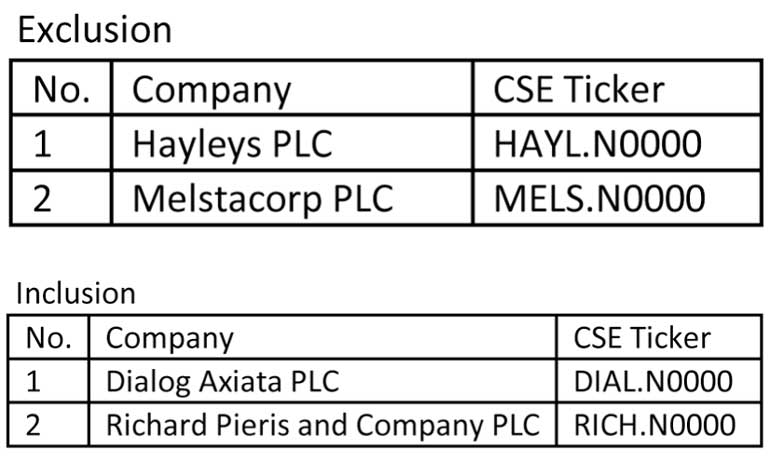

The exclusions and inclusions as announced by S&P Dow Jones Indices, effective from today (after the market close of 15 December 2017) are presented below in alphabetical order.

The S&P SL 20 index includes the 20 largest companies, by total market capitalisation, listed on the CSE that meet minimum size, liquidity and financial viability thresholds.

The constituents are weighted by float-adjusted market capitalisation, subject to a single stock cap of 15%, which is employed to reduce single stock concentration.

The S&P SL 20 index has been designed in accordance with international practices and standards. All stocks are classified according to the Global Industry Classification Standard (GICS), which was co-developed by S&P Dow Jones Indices and MSCI and is widely used by market participants throughout the world.

To be eligible for inclusion, a stock must have a minimum float-adjusted market capitalisation of Rs. 500 million, a six-month median daily value traded of Rs. 0.5 million, have been traded at least 10 days of each month for the three months prior to the rebalancing reference date and have positive net income over the 12 months prior to the rebalancing reference date. For information, including the complete methodology, visit www.spindices.com.