Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 2 July 2024 02:37 - - {{hitsCtrl.values.hits}}

The Colombo stock market yesterday began July on a negative note amidst lacklustre investor interest leading to poor trading activity.

The Colombo stock market yesterday began July on a negative note amidst lacklustre investor interest leading to poor trading activity.

Both indices were down by over 0.5% and turnover was a dismal Rs. 687 million involving mere 32.4 million shares.

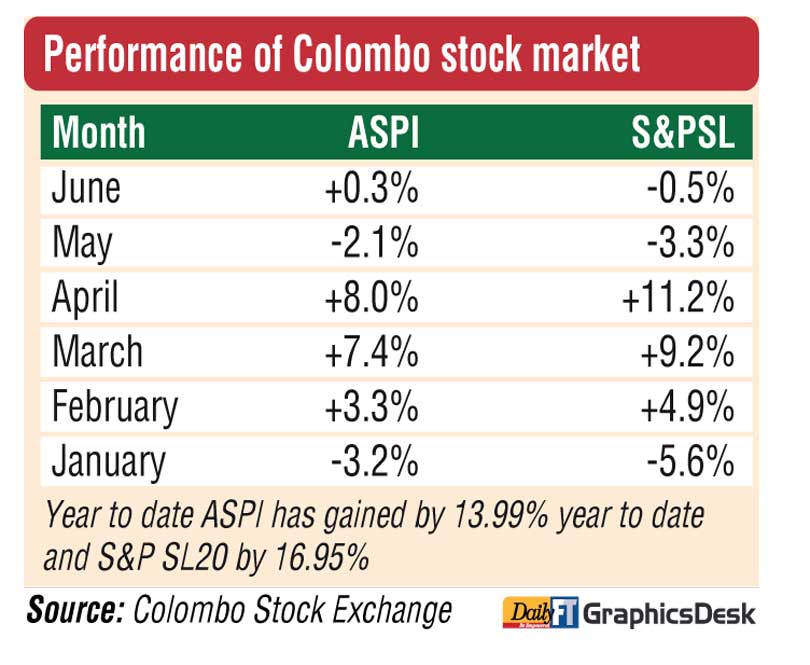

The start in July remains a concern after the market suffered its worst month in 2024 in May (see chart). However year to date the Colombo Stock Exchange (CSE) remains positive.

Asia Securities said the market remained in red territory amid limited investor activity as price losses in WATA (-6.4%), KOTA (-4.8%), RCL (-4.1%), DIPD (-2.7%), HAYL (-1.2%), and LIOC (-1.0%) weighed on the indices during the session.

Sectorally, banking stocks declined with the sector index dropping 0.8% due to price losses in COMB (-0.7%), SAMP (-0.9%) and HNB (-0.5%).

RCL (-6 points), CFIN (-6 points), and SAMP (-5 points) ended as the biggest laggards on the ASPI. Overall, 53 stocks ended in green while 112 settled with losses.

Notably, JKH saw Rs. 102mn transacted in block trades and emerged second largest contributor to turnover followed by HAYL (Rs. 141 million). Crossings accounted for 22.5% of turnover including JKH and HAY (Rs. 52.5 million).

Foreigners recorded a net inflow of Rs. 3.3 million. Net foreign buying topped in AEL at Rs. 6.0 million and selling topped in DIPD at Rs. 7.3 million.

First Capital said the broader market commenced the week by echoing the subdued sentiment of the previous week, as investors opted to maintain a wait and see approach amid lingering uncertainties and debt deal which is expected to be announced by President Ranil Wickramasinghe today in Parliament.

The ASPI experienced sideways movements throughout the trading day further reflecting the market volatility as the index halted at 12,076 recording the lowest for a month, down by 68 points amidst thin trading volumes. Banks and mid-cap companies weighed down on the index, with RCL, CFIN, SAMP, COMB, and RICH emerging as the major negative contributors. On a positive note, Construction sector counters such as AEL, ACL and ALUM were traded actively during the day, reflecting optimistic sentiment towards the Construction sector, bolstered by an increase in the Construction sector PMI for the month of May.

With the muted participation of retail investors and HNWIs, turnover fell to a one month low. Capital Goods sector contributed 51.0% to the overall turnover while Diversified Financials and Food, Beverage and Tobacco sectors jointly contributed 22%.

NDB Securities said high net worth and institutional investor participation was noted in John Keells Holdings, Hayleys and ACL Cables. Mixed interest was observed in People’s Leasing & Finance, Dipped Products and Access Engineering whilst retail interest was noted in Nation Lanka Finance, Browns Investments and Kotagala Plantations.

The Capital Goods sector was the top contributor to the market turnover (due to Hayleys, John Keells Holdings and Access Engineering) whilst the sector index lost 0.42%. The share price of Hayleys decreased by Rs. 1.25 (1.18%) to Rs. 105. The share price of John Keells Holdings gained 25 cents to Rs. 204. The share price of Access Engineering closed flat at Rs. 23.80.

The Diversified Financials sector was the second highest contributor to the market turnover (due to People’s Leasing & Finance) whilst the sector index decreased by 0.80%. The share price of People’s Leasing & Finance closed flat at Rs. 12.60.

Dipped Products was also included amongst the top turnover contributors. The share price of Dipped Products recorded a loss of 10 cents to Rs. 36.70.