Saturday Jan 25, 2025

Saturday Jan 25, 2025

Thursday, 3 August 2023 04:18 - - {{hitsCtrl.values.hits}}

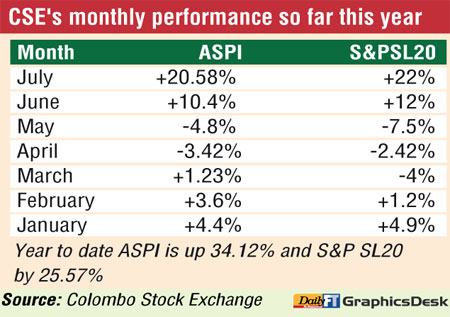

The Colombo stock market, which produced 20% in July, began August on a positive note driven by upbeat investor sentiment in the banking sector.

The Colombo stock market, which produced 20% in July, began August on a positive note driven by upbeat investor sentiment in the banking sector.

The benchmark ASPI gained by 0.5% and the active S&P Sl20 by 0.3%. Turnover improved to Rs. 3.8 billion involving 89.3 million.

Foreigners also recorded a net inflow.

Asia Securities said the indices continued their upward momentum for a fourth consecutive session led by banking sector counters DFCC (+6.8%), NDB (+4.4%), NTBN (+4.6%), COMBN (+2.8%), COMBX (+2.7%), and HNBN (+1.2%).

Meanwhile, JKH (+1.3%), KHL (+4.1%), AHUN (+5.7%), CFVF (+5.8%), FCT (+2.9%), CALT (+3.3%), and CFIN (+3.8%) recorded sizeable gains during the session supported by steady investor buying.

COMBN (+20 points), DFCC (+15 points), and NDB (+10 points) came in as the biggest index movers for the day. Overall, 98 stocks recorded price gains while 101 settled with losses.

Turnover was led by JKH (Rs. 693mn), DFCC (Rs. 497mn), and NDB (Rs. 308mn).

Asia also said a net foreign inflow of Rs. 324mn was recorded for the day supported by NDB (Rs. 173mn), COMBN (Rs. 100mn), and JKH Rs. 44mn).

First Capital said the bourse displayed an upward yet volatile movement during the day to close at 11,447 gaining 60 points.

Notable investor interaction was centered on the index heavy weights and selected banking sector shares which backed the index to continue its positive momentum.

Primary Dealer shares witnessed improved interest as the investors expected the T-Bill rates to descend at today’s auction signalled by the faster than expected drop in inflation. Hotel sector shares also experienced positive investor movement as the tourists arrivals for July recorded a sharp increase of 143,039.

On the flipside profit taking was witnessed on LIOC after gaining for the past few sessions ahead of the monthly fuel price revision.

NDB Securities said high net worth and institutional investor participation was noted in John Keells Holdings and Nations Trust Bank. Mixed interest was observed in DFCC Bank, National Development Bank and Commercial Bank whilst retail interest was noted in Browns Investments, Shaw Wallace Investments and Pan Asia Banking Corporation.

The Banking sector was the top contributor to the market turnover (due to DFCC Bank, National Development Bank, Nations Trust Bank and Commercial Bank) whilst the sector index gained 2.19%. The share price of DFCC Bank gained Rs 5.60 to Rs 87.70. The share price of National Development Bank moved up by Rs 3.40 to Rs 79.90. The share price of Nations Trust Bank recorded a gain of Rs 4.75 to Rs 107.00. The share price of Commercial Bank appreciated by Rs 2.60 to Rs 95.50.

The Capital Goods sector was the second highest contributor to the market turnover (due to John Keells Holdings) whilst the sector index increased by 0.47%. The share price of John Keells Holdings increased by Rs 2.25 to Rs 170.

Separately ACL Cables and Bansei Royal Resorts Hikkaduwa announced their dividends of Rs 1.25 and 20 cents per share respectively.