Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 22 September 2020 01:06 - - {{hitsCtrl.values.hits}}

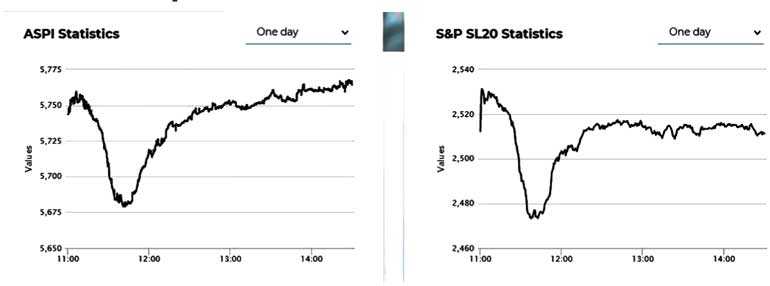

The Colombo stock market proved its resilience yesterday by closing on the up for the tenth consecutive day, after a sharp dip due to profit taking earlier on, whilst turnover yet again was over Rs. 3 billion.

“The market rallied for the tenth consecutive session on the back of the strong bullish sentiment of retailers, giving the week a green start. ASPI recorded a dip within the first hour of trading due to the selling pressure in selective Banking counters.

Thereafter the market witnessed a recovery and moved upwards and closed at 5,763 with a 42 point advance,” First Capital said.

The S&P SL20 Index however decreased by 0.03% or 0.68 points to close at 2,511.72.

Turnover was Rs. 3.52 billion, extending the continuity of the new daily average set last week.

Acuity Stockbrokers said crossings amounted to 16.7% the day’s total turnover.

Foreign investors recorded a net outflow of Rs. 401 million as against Rs. 461.6 million on Friday.

First Capital said Capital Goods and Banking counters dominated the turnover making a joint contribution of 49% led by HAYL.

Moreover the parcel trades boosted the turnover amounting to 17% of total.

Foreign investors recorded low participation dominated by the selling-side resulting in a month to date net outflow of Rs. 5 billion, First Capital added.

NDB Securities said the ASPI closed in green as a result of price gains in counters such as HNB Finance Limited, Hemas Holdings and Vallibel One.

It said high net worth and institutional investor participation was noted in Hayleys and Chevron Lubricants Lanka. Mixed interest was observed in Browns Investments, Sampath Bank and Hemas Holdings whilst retail interest was noted in Expolanka Holdings, Tokyo Cement Company nonvoting and Royal Ceramics.

Capital Goods sector was the top contributor to the market turnover (due to Hayleys and Hemas Holdings), whilst the sector index gained 1.95%. The share price of Hayleys increased by Rs. 10.50 (4.68%) to close at Rs. 234.80. The share price of Hemas Holdings recorded a gain of Rs. 3.70 (5.44%) to close at Rs. 71.70.

The Banking sector was the second highest contributor to the market turnover (due to Sampath Bank), whilst the sector index decreased by 0.32%. The share price of Sampath Bank moved down by Rs. 0.40 (0.29%) to close at Rs. 136.60.

Browns Investments and Hayleys Fabric were also included amongst the top turnover contributors. Share price of Browns Investments gained Rs. 0.10 (3.57%) to close at Rs. 2.90, while the share price of Hayleys Fabric appreciated by Rs. 1.80 (8.14%) to close at Rs. 23.90.

C T Land Development announced a final dividend of Rs. 0.75 per share.