Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 1 December 2022 00:26 - - {{hitsCtrl.values.hits}}

The Colombo stock market yesterday sustained its new-found momentum rising by over 3% thereby enabling it to finish November on a positive note after the dip in October.

The Colombo stock market yesterday sustained its new-found momentum rising by over 3% thereby enabling it to finish November on a positive note after the dip in October.

The active S&P SL20 shot up by 3.4% and the benchmark ASPI by 3.3%. More importantly, turnover rose to a new recent high of Rs. 3.3 billion involving 281.4 million shares.

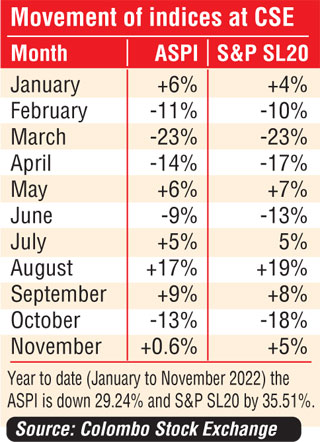

The late rally helped CSE end November up 0.6% in terms of ASPI and by 5% as per S&P SL20. This meant that CSE returned to positive momentum enjoyed between July and September before dipping in October.

Asia Securities said that yesterday the indices continued their upward trend for the fourth consecutive session and recorded their biggest single-day gains in seven weeks.

Unlike previous sessions, trading on the Exchange was more broad-based as investors were seen buying into oversold counters at bargain levels building upon the recent shift in market momentum. The ASPI surpassed the 8,600 level and closed with a gain of 276 points (+3.3%) while the S&P SL20 index crossed 2,700 to end with a 90-point gain (+3.4%).

Turnover crossed Rs. 3 billion for the first time in seven weeks, improving from its 20-day average of Rs. 1.5 billion. BIL (Rs. 555 million), EXPO (Rs. 426 million), OSEA (Rs. 293 million), and LIOC (Rs. 245 million) ended as the top turnover generators for the day. SAMP (+34 points), BIL (+25 points), LOLC (+23 points), and LOFC (+12 points) came in as the major index movers. The breadth of the market closed strong with 174 price gainers and 41 decliners.

Asia also said foreigners recorded a net inflow of Rs. 39.2 million while their participation increased to 10.2% of turnover (previous day 2.9%). Net foreign buying topped in HBS at Rs. 34 million and selling topped in JKH at Rs. 7.6 million.

First Capital said the bourse rallied for the fourth straight day while recording the highest intraday gain in 7-week after investor participation improved on the back of confirmed talks with multilateral and bilateral lenders including world banks and ADB for $ 1.9 billion after IMF board level agreement was reached.

As a result, the index displayed an unprecedented spike throughout the session while closing the day at a one-month high of 8,651, gaining 276 points. Banking sector, LOLC group together with treasury shares positively reacted to the signals issued by CB governor indicating the future direction of interest rates. Through off-board, 1.6% stake of OSEA (19.8 million shares) changed hands at Rs. 14 per share.

NDB Securities said high net worth and institutional investor participation was noted in Overseas Realty, Lanka IOC and Kelani Tyres. Mixed interest was observed in Expolanka Holdings, First Capital Holdings and Capital Alliance whilst retail interest was noted in Browns Investments, SMB Leasing (voting and nonvoting) and LOLC Finance.

The Food, Beverage and Tobacco sector was the top contributor to the market turnover (due to Browns Investments) whilst the sector index gained 3.27%. The share price of Browns Investments increased by One Rupee (15.38%) to close at Rs. 7.50.

The Diversified Financials sector was the second highest contributor to the market turnover (due to LOLC Finance) whilst the sector index increased by 6.66%. The share price of LOLC Finance appreciated by Rs. 1.30 (20%) to close at Rs. 7.80.

Expolanka Holdings, Overseas Realty and Lanka IOC were also included amongst the top turnover contributors. The share price of Expolanka Holdings gained Rs. 3.50 (1.85%) to close at Rs. 193.00. The share price of Overseas Realty moved up by 30 cents (2.19%) to close at Rs. 14. The share price of Lanka IOC recorded a gain of Rs. 1.75 (0.93%) to close at Rs. 189.50.

Separately JAT Holdings announced their first interim cash dividend of 45 cents per share.