Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 2 September 2021 00:29 - - {{hitsCtrl.values.hits}}

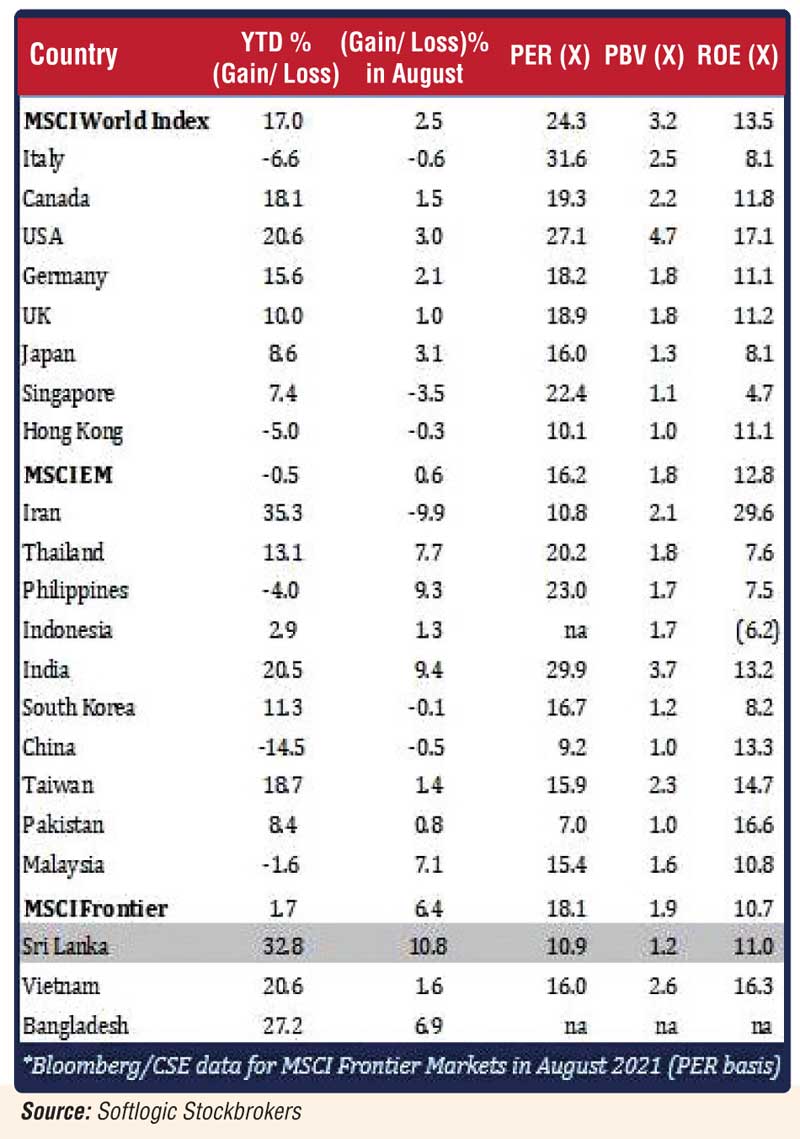

Softlogic Stockbrokers said yesterday that the Colombo Stock Exchange (CSE) was the highest gainer globally in August and second-best performer year-to-date (YTD), trading at a 40% discount to peers.

It said a strong Twelve Trailing Months (TTM) earnings drove growth as valuations remain low. It also said that the market saw an impressive start for September with ASPI surpassing 9,000 points.

"With a full cycle of strong earnings over the TTM period following the first wave of COVID, the market finally began its much-anticipated correction of multiples as the CSE gained over 11% month-on-month to settle at a market capitalisation of just over Rs. 4 trillion," Softlogic said.

"Overall, we feel investors should take a medium-term approach as the lower interest rates and infrastructure stimulus is expected to drive economic recovery," Softlogic said.

"Overall, the market retained its discounted position, trading at a PER of 10.9 times, which is at a 40% discount to the MSCI frontier market index and a 37% discount on a price-to-book value basis," it added.

It said the highest turnover generators in August were Expolanka Holdings, LOLC Holdings, Hayleys, Dipped Products and Royal Ceramics.

On the COVID front, Softlogic said, the Delta variant took its toll as the country faced 4,000-5,000 new cases daily whilst the total death tally doubled to reach 9,185 up from around 4,500 as of end July. It said therefore, the Government opted to enforce travel restrictions to contain the situation whilst continuing the vaccination drive to offset the impact.

Currently 12.5 million people have been given the first dose of the vaccine with around 8.2 million being fully vaccinated. This amounts for Sri Lanka covering 57% of the population with the first dose and over 33% being fully vaccinated.

"As such, the vaccination per capita is significantly high compared to vaccine producing nations such as India (23%) and Russia (42%)," Softlogic added.

On the economic front, the Central Bank continued its quantitative easing strategy, whilst the country successfully secured multiple funding lines, including $ 787 million via IMF's SDR facility, as well as a $ 200 million swap facility with Bangladesh and $ 300 million from the China Development Bank.