Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 1 December 2020 01:41 - - {{hitsCtrl.values.hits}}

Banks in India and Sri Lanka could post larger capital declines without public or private capital injections, a new report by Moody’s Investors Service said yesterday as uneven recoveries from COVID-19 are likely to pose risks to financial institutions in emerging markets throughout Asia.

Moderate and patchy economic recoveries amid the coronavirus pandemic as well as political and trade uncertainties pose risks for financial institutions in emerging markets throughout Asia, Latin America, Europe, the Middle East and Africa in 2021, says Moody’s Investors Service in a new report. The outlook for banks is negative, while insurers are more stable, as the lockdown from the pandemic has resulted in one-off gains in profitability, although pressures on capital are increasing.

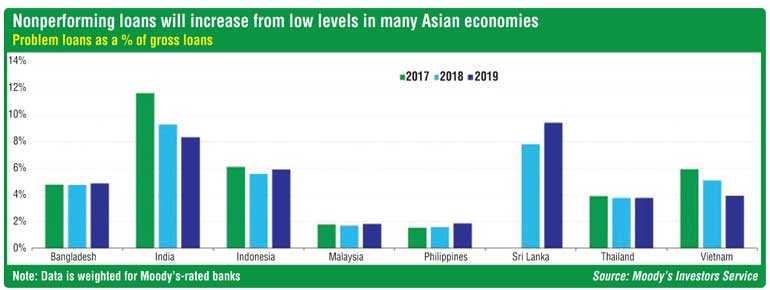

The report said non-performing loans (NPLs) will rise most for banks in India and Thailand because of the greater shock to their economies and the historically poor performance of certain loan types. In India, stress among non-bank financial institutions will also curtail their capacity to lend.

“Tangible common equity to risk-weighted assets will remain broadly unchanged or decrease modestly at most banks in emerging Asia over the next two years. This will not be significant enough to prompt us to change our views on most banks’ fundamental creditworthiness. Banks in India and Sri Lanka could post larger capital declines without public or private capital injections,” the report added.

“The uncertain trajectory of asset quality is among the biggest risks for banks as operating environments remain fragile amid ongoing health concerns,” says Moody’s Managing Director Celina Vansetti-Hutchins. “Profit growth will be modest because of low interest rates and subdued lending, but lower loan volumes should aid capital. Additionally, banks’ lending and funding shifts in response to flatter yield curve dynamics and low rates will also pressure net interest margins.”

In Asia-Pacific, banks’ rising nonperforming loans and insurers’ volatile investment portfolios are in focus. Capital will moderately fall in emerging Asia over the next two years, and banks in India and Sri Lanka will post larger capital declines without public or private injections. In the insurance space, China is the most relevant player in emerging Asian markets. Moody’s has a stable outlook on most lines of business given solid capitalisation, but rising equity allocations will add to investment income volatility.

In EMEA, operating conditions will be challenging. In Africa, asset quality, profitability and foreign currency liquidity will remain banks’ key pressure points. Across the CIS, large loan impairments will increase because of the double economic shock of the pandemic and oil price slump.

Pressure on fundamentals will also carry over to CEE banks, but economies contracted more mildly than EU peers and are set for a stronger recovery in 2021. GCC banks may get a boost from large projects like the Expo and FIFA World Cup, while insurers are vulnerable to intensifying pricing competition.

Turkish banks’ creditworthiness will remain weak and under pressure.

In Latin America, asset risks loom large. Loan growth will be modest, particularly in Mexico, given an uneven economic recovery and ongoing health risks. High reserve buffers in Brazil and Colombia will protect against uncertainties in asset risk and market volatility, but low rates will hurt margins. Ample liquidity and improving capital will support new lending and overall creditworthiness.

Moody’s notes that weak medium-term economic growth will limit Latin American insurers’ premium growth, which could lead to softer underwriting practices for certain segments participating in highly competitive markets.