Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 2 November 2021 03:08 - - {{hitsCtrl.values.hits}}

The Central Bank (CBSL) yesterday announced maximum interest rates as part of its measures to ensure effective benefits to all stakeholders.

The move is as per the Finance Business Act (Maximum Interest Rates on Deposits and Debt Instruments) Direction No. 01 of 2019 and Finance Business Act (Amendments to the Maximum Interest Rates on Deposits and Debt Instruments) Direction No. 04 of 2020.

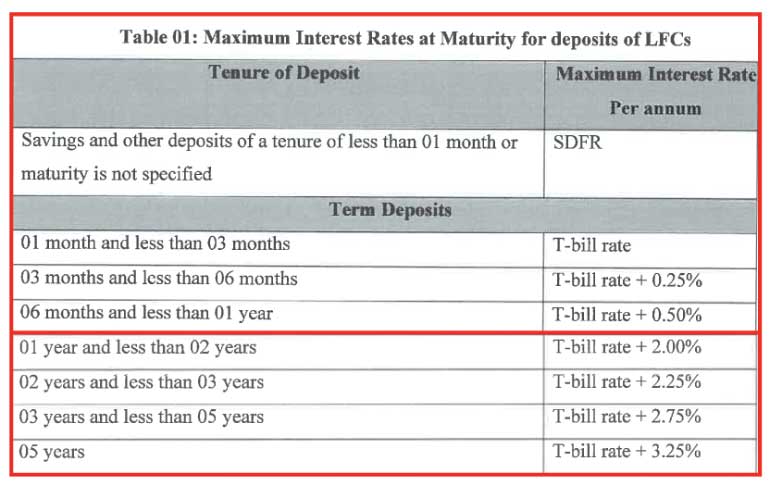

The CBSL said the maximum interest rates that may be offered or paid by Licenced Finance Companies (LFCs) on Sri Lankan Rupee deposits shall not exceed the interest rates derived in accordance with Table 01 below and will replace Direction l.l.(i) of the Finance Business Act Direction No.04 of 2020 on Amendments to the Maximum Interest Rates on Deposits and Debt Instruments. The revised rates will be applicable with effect from 01.11.2021 and be effective until further notice.

Banking sources said the 12-month Fixed Deposit rate ceiling has been increased to 9.88% per annum with 50 basis points extra for senior citizens.

The maximum interest rates derived for debt instruments as in Direction 1.2 of the Finance Business Act Direction No.04 of 2020 on Amendments to the Maximum Interest Rates on Deposits and Debt Instruments will remain the same.

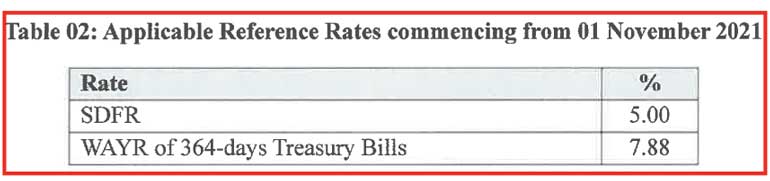

The applicable SDFR and WAYR of 364-day T-Bills on deposits and debt instruments are as in Table 02.