Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 26 October 2021 02:19 - - {{hitsCtrl.values.hits}}

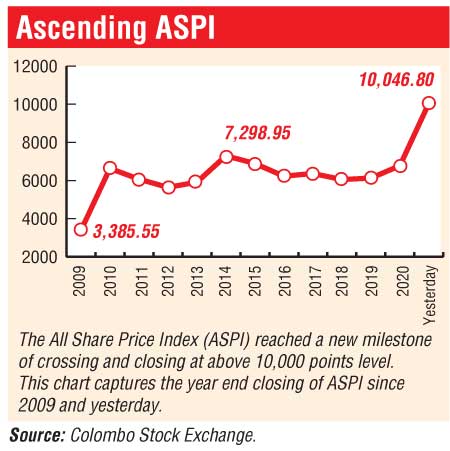

The Colombo stock market yesterday achieved a new milestone of its benchmark index ASPI, crossing the 10,000 points level as investors turned bullish with active trading on expectations of improved corporate earnings despite the impact of the pandemic.

The All Share Price Index gained by over 131 points or 1.3% to close at 10,046.80. Intra-day peak of ASPI was 10,080. On Friday, it briefly touched the 10,000 points level but failed to close above the magical figure. The S&PSL20 Index gained by 39 points or 1%. Turnover rose to a near four-week high of Rs. 6.85 billion involving 236 million shares.

CSE’s new unicorn, the most valuable and profitable listed entity, Expolanka continued to be on demand as it gained by 7.5% or Rs. 15.75 to close at Rs. 224.75. Expo saw 10.8 million of its shares changing hands via 6,394 trades for Rs. 2.4 billion, including Rs. 18.4 million in net foreign buying. The gain contributed a dominant 69 points to ASPI’s upward movement. Expolanka’s market capitalisation rose further to Rs. 439.36 billion or $ 2.16 billion.

The surpassing of the latest 1,000 points was faster as opposed to previous ones. The ASPI crossed the 7,000 points mark in January and surpassed the 8,000 points mark in late July whilst the 9,000 points level was achieved in September. Proving the market’s resilience, the ASPI is up 48.3% YTD (YTD) whilst the S&PSL20 is higher by 38%.

Separately, CSE’s market capitalisation crossed the 50% YTD growth to 51.22%, to Rs. 4.47 trillion.

Asia Securities said the ASPI surged past the 10,000 mark and closed above the historic milestone for the first time ever while the more liquid S&P SL 20 index also scaled a record closing high at 3,645 (+39 points), surpassing its previous all-time high recorded earlier this month (3,619).

It said yesterday’s turnover was the highest since 30 September 2021 and was supported by active retail and HNI buying in EXPO which accounted for 35% of total turnover.

On the sectoral front, Asia said certain manufacturing counters sustained their recent positive momentum on the back of optimism around the ongoing earnings season.

“Earlier, the ASPI started the week on an upbeat note crossing the 10,000 level minutes after market open and remained in positive territory throughout trading to close in green for a sixth straight session,” Asia said, adding the overall market breadth was neutral with price gainers and decliners tallying 97 counters each.

Foreigners recorded a net outflow of Rs. 33.8 million while their participation declined to 1.3% of turnover (Friday, 2.6%). Net foreign buying topped in Expo at Rs. 18.4 million and net selling topped in Amana Bank at Rs. 26.3 million.

First Capital said the bourse extended its bull rally for the sixth straight session and made history by surpassing the 10,000 psychological level while recording turnover at a three and half week high fueled by high retail participation.

“The index opened on a bullish note but lost momentum shortly. Subsequently, the index regained momentum at a slow pace followed by a steady upswing during the final hour of the session as optimistic investors picked up their buying spree hitting an intraday high of 10,080 before closing for the day at a fresh all-time high of 10,047,” First Capital added.

It said turnover was led by a joint contribution of 62% from the Transportation sector and Capital Goods sector.

NDB Securities said the ASPI closed in green as a result of price gains in counters such as Expolanka Holdings, Commercial Leasing and Finance, and Vallibel One.

It said high net worth and institutional investor participation was noted in John Keells Holdings, Hatton National Bank nonvoting and Expolanka Holdings. Mixed interest was observed in Vallibel One, ACL Cables and LOLC Holdings, whilst retail interest was noted in SMB Leasing voting and nonvoting, and Browns Investments.

The Transportation sector was the top contributor to the market turnover (due to Expolanka Holdings), whilst the sector index gained 7.52%.

The Capital Goods sector was the second-highest contributor to the market turnover (due to Vallibel One and ACL Cables), whilst the sector index increased by 1.96%. The share price of Vallibel One gained Rs. 5.50 (8.59%) closing at Rs. 69.50. The share price of ACL Cables recorded a gain of Rs. 4.40 (8.38%) to close at Rs. 56.90.

Browns Investments and LOLC Holdings were also included amongst the top turnover contributors. The share price of Browns Investments closed flat at Rs. 10.70. The share price of LOLC Holdings declined by Rs. 4.75 (0.73%) to close at Rs. 647.50.