Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 3 May 2023 00:35 - - {{hitsCtrl.values.hits}}

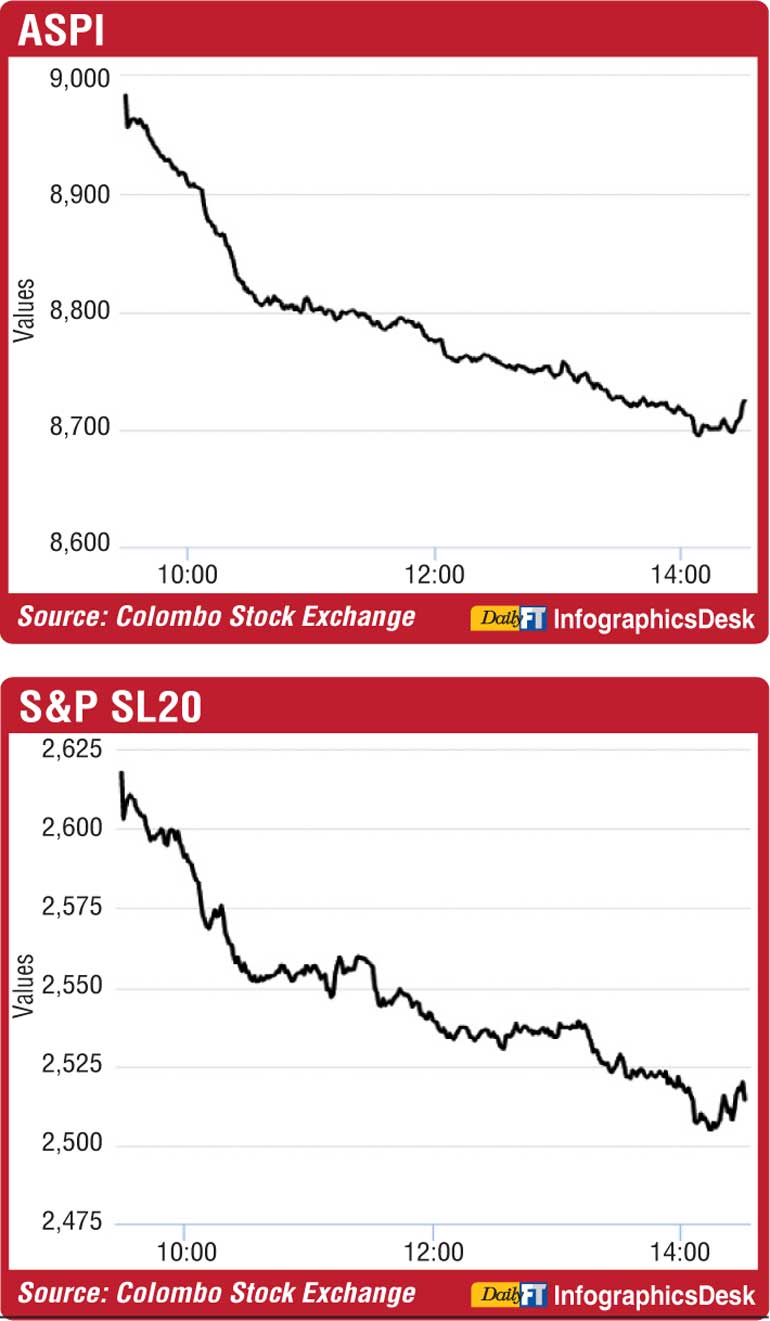

The Colombo stock market yesterday suffered the highest daily loss in six months with the benchmark index plunging to a three-month low due to lacklustre sentiment and investors increasingly getting frustrated over extended hours of trading.

The active S&P SL20 plunged by 4% and the benchmark ASPI by 3%. The fall extended S&P SL20’s year to date loss to near 5% and erased the ASPI’s gain to 2.6% thereby running the risk of shifting to negative territory.

The CSE in April saw both indices suffer their first monthly loss as well.

Turnover yesterday was Rs. 984 million involving 52.4 million shares.

Apart from negative sentiments on outlook for equities investors are also bickering over the SEC-CSE decision to revert to full pre-COVID trading hours until 2.30 p.m.

Asia Securities said the market commenced the week sharply negative with the indices recording their biggest single-day losses in the last six months mainly due to retail sell-off in EXPO, LIOC, and LOLC group stocks while banking counters also witnessed high selling pressure on market speculations around domestic debt-restructuring.

The ASPI ended with a heavy loss of 272 points (3%) and the S&P SL20 index closed 103 points (4%) lower.

EXPO (-7.2%), LIOC (-3.5%), LOFC (-5.5%), LOLC (-4.5%), COMBN (-4.4%), BIL (-5.4%), SCAP (-9.6%), HNB (-4.1%), AAIC (-7.4%), and VONE (-7.3%) scaled sharp price declines during the session. VONE (-27 points) came in as the biggest laggards on the ASPI, followed by EXPO (-20 points), and SAMP (-19 points).

Turnover stood was led by EXPO (Rs. 189 million), LIOC (Rs. 78 million), and BIL (Rs. 75 million).

Asia also said foreigners recorded a net outflow of Rs. 0.8 million. Net foreign buying topped in SUN at Rs. 19.5 million and selling topped in DIAL at Rs. 31.8 million.

First Capital said the ASPI closed in red at 8,711 and hit nearly a 3-month low, losing 272 points. The banking sector was the biggest drag on the index due to selling interest witnessed amidst DDR concerns. Furthermore, EXPO also dragged down the index mainly due to poor results, as it reported a loss of Rs. 1,171.4 million for the March 2023 quarter.

NDB Securities said high net worth and institutional investor participation remained subdued for the day whilst mixed interest was observed in Expolanka Holdings, Lanka IOC and Dialog Axiata. Retail interest was noted in Browns Investments, Industrial Asphalts and LOLC Finance.

The Transportation sector was the top contributor to the market turnover (due to Expolanka Holdings) whilst the sector index lost 7.18%. The share price of Expolanka Holdings decreased by Rs. 11.50 (7.19%) to Rs. 148.50.

The Food, Beverage & Tobacco sector was the second highest contributor to the market turnover (due to Browns Investments) whilst the sector index decreased by 1.50%. The share price of Browns Investments moved down by 30 cents to Rs. 5.30.

Lanka IOC, Dialog Axiata and Royal Ceramics were also included amongst the top turnover contributors. The share price of Lanka IOC lost Rs. 5.75 (3.49%) to Rs. 159 despite reporting impressive FY23 earnings.

The share price of Dialog Axiata closed flat at Rs. 11. The share price of Royal Ceramics declined by 70 cents to Rs. 26.80.