Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 24 September 2024 04:18 - - {{hitsCtrl.values.hits}}

The Colombo stock market enjoyed a day of gain as investors showed signs of positivism over the election of Anura Kumara Dissanayake as the new President, though turnover was low.

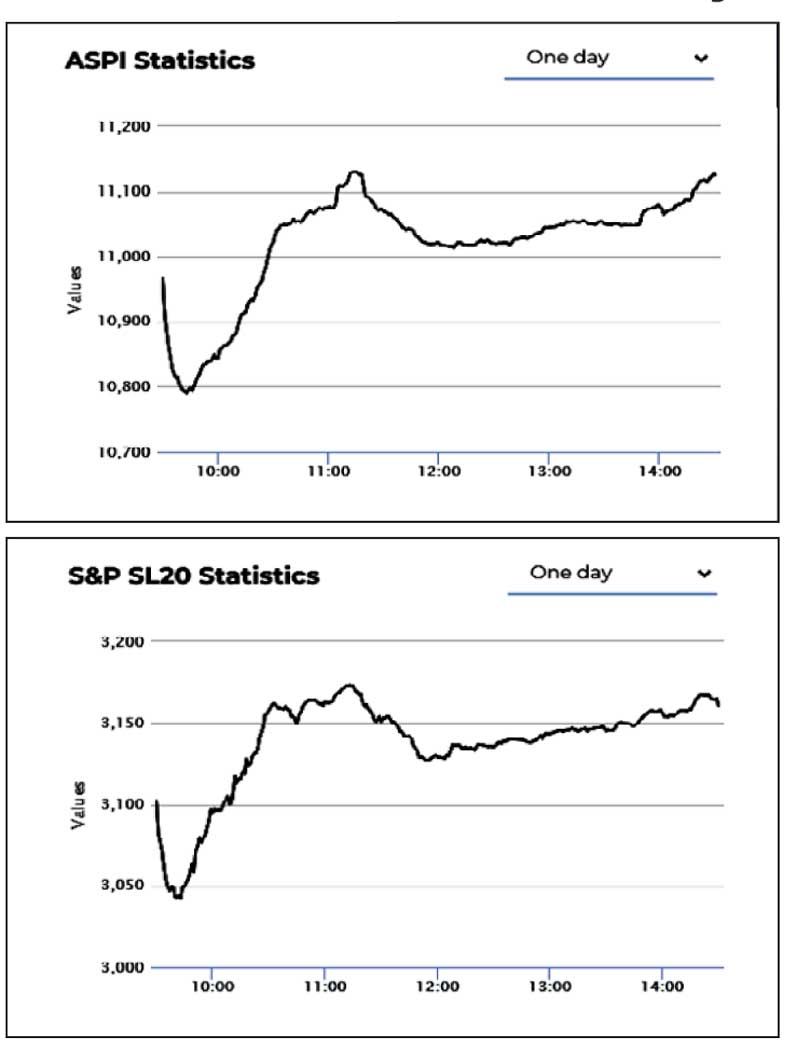

The benchmark ASPI gained by 130 points or 1.19%, and the active S&P SL20 by over 58 points or 1.9%. Turnover was Rs. 994.4 million involving 49 million shares.

The closing was commendable after the market plunged by over 200 points in early trading.

There has been a general view that listed equity investors were wary if either incumbent President Ranil Wickremesinghe or Opposition Leader Sajith Premadasa wasn’t elected at last Saturday’s poll. However, the late rally proved a change in sentiment; the credence of which hinges on the market sustaining the upward trajectory going forward.

First Capital said, despite experiencing a volatile trading session, the Colombo bourse closed the session in green for the fifth consecutive day as investors continued the positive sentiment from the previous week following the Presidential election.

The benchmark index, ASPI, experienced a steep decline of over 180 points during the first few minutes, yet recovered gradually during the day and closed the session at 11,097, gaining 130 points. Banking sector companies and blue-chip stocks gained momentum where COMB, HNB, SAMP, SPEN, and MELS emerged as the top positive contributors to the index. Turnover saw a decline from the previous session, but marked a 2.6% increase from the month’s average amidst improved participation of retail investors.

Moreover, the Banking sector solely contributed 36% to the overall turnover, whilst the Capital Goods and Diversified Financials sectors jointly contributed 32% to total turnover.

Foreign investors remained net sellers, with a net outflow of Rs. 5.2 million.

NDB Securities said indices closed in green as a result of price gains in counters such as Hatton National Bank, Commercial Bank, and Sampath Bank.

High net worth and institutional investor participation remained subdued for the day. Mixed interest was observed in Commercial Bank, Hatton National Bank, and Sampath Bank, whilst retail interest was noted in LOLC Finance, Browns Investments, and Softlogic Capital.

The Banking sector was the top contributor to the market turnover (due to Commercial Bank, Hatton National Bank, and Sampath Bank), whilst the sector index gained 2.31%. The share price of Commercial Bank increased by Rs. 2.50 to Rs. 90.90. The share price of Hatton National Bank gained Rs. 5.50 to Rs. 174.25. The share price of Sampath Bank moved up by Rs. 1.40 to Rs. 74.

The Capital Goods sector was the second highest contributor to the market turnover whilst the sector index increased by 0.97%. LOLC Finance and Browns Investments were also included amongst the top turnover contributors. LOLC Finance closed flat at Rs. 5.50. The share price of Browns Investments also closed flat at Rs. 5.30.