Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 21 March 2022 02:24 - - {{hitsCtrl.values.hits}}

The Condominium Property Volume Index compiled by the Central Bank has increased significantly during Q4-2021 with a notable increase of 49.0% compared to Q4, 2020 and with a growth of 48.4% compared to Q3-2021.

The Condominium Property Volume Index compiled by the Central Bank has increased significantly during Q4-2021 with a notable increase of 49.0% compared to Q4, 2020 and with a growth of 48.4% compared to Q3-2021.

In the backdrop of inflationary pressures and the relatively low levels of return earned on traditional investment avenues, investors are moving toward non-traditional investment avenues, among which investment on apartments is becoming increasingly popular.

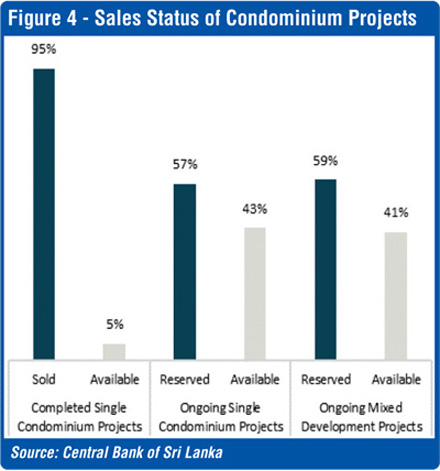

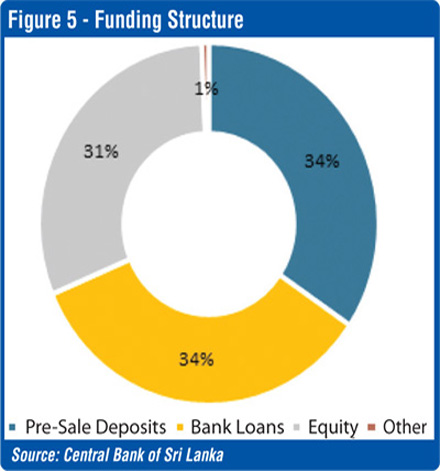

Further, an observable shift is seen in the price categories of transactions. While 77% of transactions were priced below Rs. 25 million a year ago, it has reduced to 49% in Q4-2021. Moreover, the Single Condominium projects in the Colombo district remain to be the most preferred category in Q4-2021.

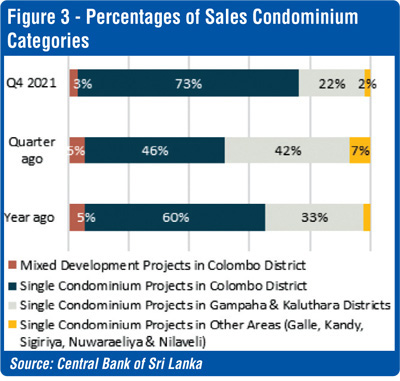

Pre-sale deposits, bank loans and equity were the three key funding sources for condominium developments. The proportion of bank loans have increased marginally over the last year. The proportions were calculated to get an overall understanding about the funding structure of condominium developments by averaging the percentages of funds received through different funding sources provided by each developer.

Most condominium buyers were Sri Lankan residents and only a few condominiums were purchased by dual citizens and foreigners.

Purchase of condominiums for investment purposes and for future living has increased during Q4-2021 while the proportions of purchases for immediate living and for rent have reduced significantly. The prime source of funding used for condominium purchasing remained to be buyers’ own funds, while on average 27% of buyers have obtained bank loans during Q4-2021.

This market analysis is based on the Condominium Market Survey conducted by the Central Bank of Sri Lanka for Q4-2021 and 22 condominium property developers participated in this survey round.

Condominium Property Volume Index is compiled to capture the variations in market activities by way of number of sales transactions reported for the reference period. (Base period: Q3, 2017 = 100).