Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 1 February 2018 00:01 - - {{hitsCtrl.values.hits}}

Depressed performance by the consumer and leisure segments has inflicted the first dip in quarterly profit in one-and-a-half years for premier blue chip John Keells Holdings PLC (JKH).

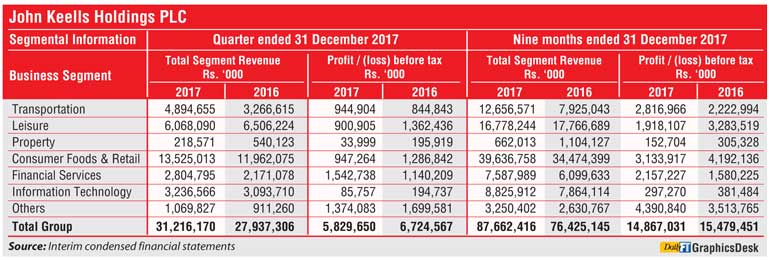

Pre-tax loss of leisure was down 34% in the third quarter whilst that of consumer foods and retail was lower by 25%. For the nine months, the pre-tax profits were down 41% and 25% respectively. Property and IT sectors too were down (see table).

Last time JKH suffered a quarterly dip year on year was in March 2016 which was hot on the heels of a dip in December 2015.

On 30 January, JKH announced its FY18 third quarter consolidated pre-tax profit was down 13% to Rs. 5.8 billion and first nine months figure down 4% to Rs. 14.87 billion. Post-tax profit in 3Q was down 15% to Rs. 4.8 billion and 5% to Rs. 11.8 billion for the nine months. JKH’s bottom line was down 2% to Rs. 11 billion for the nine months and 13% to Rs. 4.49 billion in 3Q.

Rising costs and decline in sales had contributed consumer segment business of JKH, whilst leisure was impacted by closure of two resorts in the Maldives and low occupancy in city hotels in Colombo, as a result of the increase in room inventory, whilst Bentota Beach remained closed as well.

In his review accompanying interim results, JKH Chairman Susantha Ratnayake said the beverage and frozen confectionery businesses recorded a decline in volumes as a result of continued tapering of demand, arising from subdued consumer discretionary spending.

“The volume decline in the beverage business was further exacerbated by the implementation of a sugar tax from November 2017, which resulted in substantial price increases across the industry,” Chairman added.

He said whilst over the years the company has taken measures to reduce a significant quantum of sugar in its beverages, it will continue to aggressively expand its low-sugar product range by accelerating the launch of such new products. As a continuing part of its beverage portfolio strategy, it will also launch more non-carbonated beverages to broaden our offerings. Keells Food Products PLC recorded an increase in profitability on account of a better sales mix.

The retail sector recorded growth in footfall contributing towards a year-on-year growth in same store sales, although profitability was impacted by store expansion related costs and promotional expenses. During the quarter under review, three new outlets were opened, bringing the total store count to 72 as at 31 December 2017.

On the leisure sector, Ratnayake said it was encouraging that the total number of rooms occupied in the city witnessed double-digit growth in 3Q. “Whilst the Sri Lankan resorts segment recorded an improvement in room rates and maintained occupancies, profit for the quarter under review was lower when compared to the corresponding period of the previous financial year which included the operations of Bentota Beach by Cinnamon, which is now closed for the construction of a new hotel.

JKH Chairman said the Maldivian resorts segment recorded an improvement in average room rates, although profitability was impacted by lower occupancies and the partial closure of Ellaidhoo Maldives by Cinnamon for refurbishments in October 2017. “However, occupancies at our hotels remained above the industry average during 3Q,” he added.

JKH’s longstanding transportation sector has managed to sustain itself with improved revenue and pre-tax profits whilst financial services continues to perform well.

Group revenue in the 3Q was up 12% to Rs. 31.2 billion and for nine months it was up 15% to Rs.87.66 billion.

JKH on 30 January announced a second interim dividend of Rs. 2 per share for FY18. In November 2017, it paid the first interim dividend of Rs. 2 per share.